Market Analysis

In-depth Analysis of Commercial Insulation Market Industry Landscape

The commercial insulation market is a dynamic and evolving sector that plays a crucial role in enhancing energy efficiency and sustainability in buildings. Market dynamics in this industry are influenced by various factors, including regulatory mandates, technological advancements, and the growing awareness of environmental issues. One significant driver of market growth is the increasing focus on energy conservation and the need to reduce greenhouse gas emissions. Governments and organizations worldwide are implementing stringent building codes and standards to promote energy-efficient construction practices, creating a substantial demand for commercial insulation solutions.

Technological innovations also play a pivotal role in shaping the market dynamics of commercial insulation. Continuous research and development efforts lead to the introduction of advanced materials and techniques, allowing for more effective insulation solutions. High-performance materials such as aerogels and vacuum insulation panels are gaining traction in the market due to their superior thermal properties. Additionally, the integration of smart insulation technologies, such as sensors and automated controls, is becoming more prevalent, providing real-time monitoring and optimization of insulation performance.

Market dynamics are further influenced by the construction industry's cyclic nature and economic conditions. Periods of economic growth often lead to increased construction activities, resulting in higher demand for commercial insulation. On the other hand, economic downturns can temporarily slow down construction projects, impacting the market dynamics. However, the long-term trend toward sustainable and energy-efficient building practices remains a constant driver, mitigating the effects of economic fluctuations.

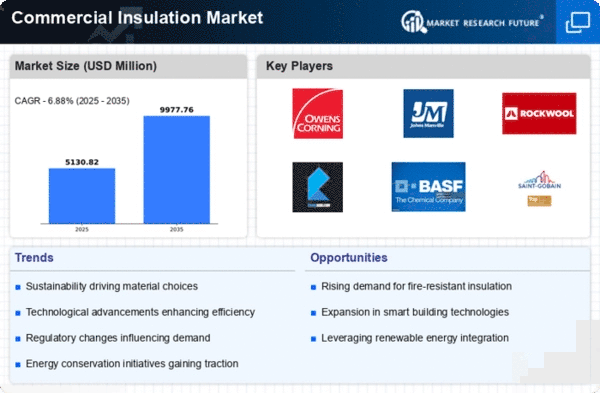

The competitive landscape is another crucial aspect of the commercial insulation market dynamics. A growing number of companies are entering the market, offering a wide range of insulation products and services. This competition encourages innovation and cost efficiency, driving advancements in insulation materials and installation methods. Additionally, market players are increasingly focusing on strategic collaborations, mergers, and acquisitions to strengthen their market presence and expand their product portfolios.

Environmental considerations also play a significant role in shaping the market dynamics of commercial insulation. As businesses and consumers become more environmentally conscious, there is a growing demand for insulation materials that have minimal environmental impact. Sustainable and recyclable materials are gaining popularity, and manufacturers are increasingly incorporating eco-friendly practices into their production processes.

The global shift towards renewable energy sources and the emphasis on reducing carbon footprints are further influencing the commercial insulation market dynamics. Governments and businesses are increasingly investing in sustainable building practices, creating a favorable environment for the adoption of energy-efficient insulation solutions.

The market dynamics of the commercial insulation industry are multifaceted and continually evolving. Regulatory initiatives, technological advancements, economic conditions, competition, and environmental considerations collectively shape the trajectory of this dynamic market. As the world strives towards more sustainable and energy-efficient construction practices, the commercial insulation market is poised for growth and innovation in the coming years.

Leave a Comment