Top Industry Leaders in the Commercial Aircraft Gas Turbine Engine Market

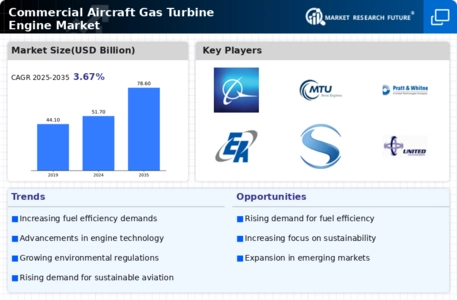

The Commercial Aircraft Gas Turbine Engine market stands as a vital segment within the aviation industry, characterized by robust competition, cutting-edge technological advancements, and strategic maneuvers among key players vying for market prominence. Gas turbine engines serve as the core powerplants for commercial aircraft, propelling them efficiently and reliably through the skies. This market has experienced substantial growth owing to the escalating demand for air travel, fleet modernization initiatives, and the pursuit of more fuel-efficient and environmentally friendly engines.

Competitive Landscape Analysis:

- Pratt & Whitney - United Technologies Corporation (US),

- GE (US),

- Rolls Royce (UK),

- Safran (France),

- Engine Alliance (US),

- CFM International (US),

- International Aero Engines AG (US),

- Honeywell International (US),

- MTU Aero Engines (Germany).

Strategies adopted by these key players revolve around continuous innovation, research and development initiatives, strategic partnerships, and a focus on environmental sustainability. These companies continually invest in R&D to develop next-generation engine technologies, emphasizing fuel efficiency, reduced emissions, enhanced durability, and improved performance. Collaborations with aircraft manufacturers and airlines for joint development projects and the formation of global service networks enable expanded reach and comprehensive support services.

Factors influencing market share analysis in the Commercial Aircraft Gas Turbine Engine sector encompass technological advancements, engine performance, fuel efficiency, reliability, lifecycle costs, aftermarket support, and environmental impact. Companies excelling in providing engines that offer superior performance, reduced fuel consumption, lower maintenance requirements, and comply with stringent environmental regulations tend to secure a competitive edge. Additionally, the ability to offer comprehensive aftermarket services, including maintenance, repair, and overhaul (MRO) solutions, significantly impacts market leadership.

The landscape also witnesses the emergence of new and innovative companies aiming to penetrate the market. Emerging players like Aero Engine Corporation of China (AECC), MTU Aero Engines AG, and Commercial Aircraft Corporation of China (COMAC) specialize in specific engine segments or bring novel engine technologies aiming to challenge the dominance of established players. These newcomers introduce fresh competition, technological advancements, and specialized expertise, intensifying competition and fostering innovation within the Commercial Aircraft Gas Turbine Engine market.

Industry news reflects the market's dynamism, with frequent announcements of significant contracts, technological advancements, and collaborations. Developments in sustainable aviation fuels, advancements in additive manufacturing for engine parts, introduction of geared turbofan engines, and investments in hybrid-electric or hydrogen-powered propulsion systems are notable trends shaping the sector. Additionally, news about new engine certifications, aircraft orders, and regulatory changes significantly influence market dynamics.

Current company investment trends in the Commercial Aircraft Gas Turbine Engine market emphasize substantial allocations to research and development, technological advancements, and sustainability initiatives. Key players invest significantly in developing new engine architectures, materials, and manufacturing processes to enhance engine performance and efficiency. Strategic investments in exploring alternative fuels, hybrid-electric propulsion, and sustainability initiatives to reduce carbon footprint remain focal points for market expansion.

Overall, the competitive scenario in the Commercial Aircraft Gas Turbine Engine market is marked by intense rivalry among established players, the emergence of innovative newcomers, ongoing technological advancements, and a persistent pursuit of enhancing engine performance and sustainability. The trajectory of this market is shaped by companies' abilities to stay at the forefront of technological innovation, align with evolving environmental standards, comply with regulatory requirements, and efficiently manage operational costs. As airlines prioritize efficient and environmentally friendly engines for their fleets, the Commercial Aircraft Gas Turbine Engine market remains dynamic and poised for further growth and innovation, promising a future characterized by cutting-edge engine technologies and sustainable propulsion systems.

Recent Development:

In February 2022, General Electric Aviation secured a substantial $517 million contract award for the engineering, manufacturing, and development phase of the Improved Turbine Engine Program (ITEP) designed for U.S. Army helicopters. This significant contract underlines General Electric Aviation's pivotal role in advancing the development of improved turbine engines, emphasizing their commitment to enhancing the capabilities of military helicopter fleets.