Rising Air Travel Demand

The Commercial Aerospace Market is witnessing a surge in air travel demand, driven by increasing disposable incomes and a growing middle class in various regions. As more individuals and businesses seek air travel for leisure and commerce, airlines are expanding their fleets to accommodate this demand. Recent statistics indicate that passenger traffic is expected to grow at an annual rate of approximately 4.5% over the next decade. This growth necessitates the production of new aircraft, thereby stimulating the Commercial Aerospace Market. Additionally, the rise of low-cost carriers has made air travel more accessible, further propelling demand. Airlines are likely to invest in modern, fuel-efficient aircraft to meet this demand while also addressing environmental concerns, thus shaping the future landscape of the industry.

Technological Advancements

The Commercial Aerospace Market is experiencing rapid technological advancements that are reshaping aircraft design and manufacturing processes. Innovations such as advanced materials, improved aerodynamics, and enhanced propulsion systems are driving efficiency and performance. For instance, the introduction of composite materials has reduced aircraft weight, leading to lower fuel consumption and operational costs. Furthermore, the integration of artificial intelligence and automation in manufacturing processes is streamlining production, thereby increasing output and reducing lead times. According to recent data, the aerospace sector is projected to invest over 100 billion dollars in research and development by 2027, indicating a strong commitment to innovation. These advancements not only enhance the competitiveness of manufacturers but also contribute to the overall growth of the Commercial Aerospace Market.

Emerging Markets and Global Expansion

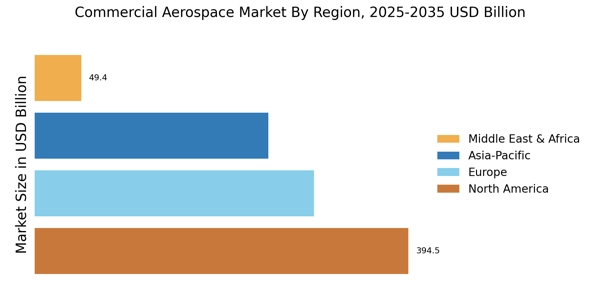

The Commercial Aerospace Market is witnessing growth opportunities in emerging markets, where increasing urbanization and economic development are driving demand for air travel. Countries in Asia, Africa, and Latin America are experiencing rapid growth in their aviation sectors, with new airports and infrastructure projects being developed to accommodate this expansion. For instance, the International Air Transport Association (IATA) forecasts that the Asia-Pacific region will account for nearly 40% of global air traffic by 2035. This trend presents significant opportunities for aircraft manufacturers and service providers to tap into these burgeoning markets. As airlines in these regions expand their fleets, the Commercial Aerospace Market is likely to see increased orders for new aircraft, thereby contributing to overall market growth. The potential for partnerships and collaborations in these emerging markets further enhances the prospects for the industry.

Sustainability and Environmental Concerns

The Commercial Aerospace Market is increasingly focusing on sustainability and addressing environmental concerns. With growing awareness of climate change and its impacts, stakeholders are prioritizing the development of eco-friendly aircraft and sustainable aviation fuels. The industry is under pressure to reduce carbon emissions, with targets set to achieve net-zero emissions by 2050. This shift is prompting manufacturers to invest in research and development of alternative propulsion systems, such as electric and hybrid technologies. Additionally, airlines are exploring operational efficiencies to minimize their environmental footprint. According to recent projections, the market for sustainable aviation fuels is expected to reach 15 billion dollars by 2030, reflecting the industry's commitment to sustainability. This focus on environmental responsibility is likely to shape the future strategies of companies within the Commercial Aerospace Market.

Regulatory Compliance and Safety Standards

The Commercial Aerospace Market is heavily influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations are designed to ensure the safety and reliability of aircraft operations, which is paramount in maintaining public trust in air travel. Manufacturers are required to adhere to rigorous testing and certification processes, which can drive innovation as companies seek to meet or exceed these standards. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are among the key regulatory bodies that set these standards. Compliance with evolving regulations often necessitates investment in new technologies and processes, thereby impacting the operational dynamics of the Commercial Aerospace Market. As safety remains a top priority, the industry is likely to see continued emphasis on compliance, which may influence design and manufacturing practices.