Collimating Lens Size

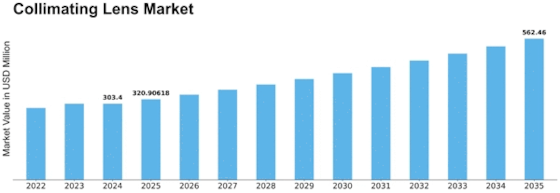

Collimating Lens Market Growth Projections and Opportunities

This study about collimating lenses worldwide gives us a lot of information about how they are used and where. It talks about things like trends in the industry, how the market behaves, how big it is, who the competitors are, and where there are chances for growth. They sorted the information based on the source of light, the material used, the wavelength, who uses them, and in which part of the world. A collimating lens is something that helps light move in a straight line without spreading out. For example, they use these lenses in devices like spectrometers or light meters to make sure the light going in is all parallel and covers the right area for measurement. These lenses are very helpful in controlling what we can see, how well a device works, and how clear the pictures or measurements are. They also help make the light beams narrower, which makes things more visible. Collimating lenses are not just for measurement tools; they are also used in things like display measurements. When we measure displays, like screens on phones or TVs, collimating lenses help analyze things like color, brightness, response time, and more. The design of these lenses is crucial in getting accurate measurements and making high-quality displays. These lenses are also used in measuring light, especially when looking at surfaces that give off light, like OLED panels. Depending on the device used for measurement, we can find out things like the type of light, its color, and if there is any flickering. The market for collimating lenses is divided based on the light source, materials, wavelength, and who uses them. For instance, when it comes to light sources, they are divided into categories like LED, laser, xenon lamps, infrared light, and RGB. The study says that the laser category had the biggest market share in 2021 and is expected to keep growing. In terms of materials, they use things like molded glass or molded plastic for these lenses. The study found that molded glass had the most significant market share in 2021 and is expected to stay on top. When it comes to the color of light (wavelength), they grouped it into different categories. The study says that light with a wavelength of less than 1000 Nm had the biggest market share in 2021. But, they predict that the categories with a wavelength of 2001 Nm and above will grow the most from 2022 to 2030. Collimating lenses are used in various fields like automobiles, medical devices, lidar, light and display measurements, spectroscopy, interferometry, and more. According to the study, the Light and Display Measurement category had the most significant market share in 2021 and is expected to lead the market in the coming years. This study also looked at the regions of the world. Asia-Pacific is expected to be the leader in the collimating lens market during the study period. The global market for collimating lenses is competitive, with many companies offering different solutions. Some of the major companies mentioned in the study include Lightpath Technologies, Ocean Insight, INGENRIC, Trioptics GmbH, Avantes BV, Auer Lighting GmbH, Optikos, IPG Photonics Corporation, The Optoelectronics company, Thorlabs, Inc., AMS Technology AG, Axetris AG, Bentham, Focuslight Technologies Inc., Edmund Optics Inc., and Quarton Inc.

Leave a Comment