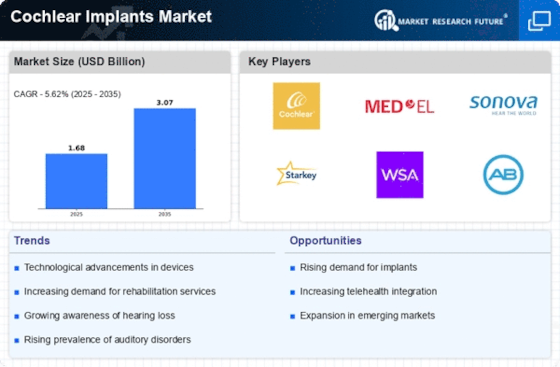

The Cochlear Implants Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and an increasing prevalence of hearing loss globally. Advancements in remote programming and telehealth are also helping established players maintain their cochlear implant manufacturers market share by improving patient retention.

Key players such as Cochlear Limited (AU), Med-El Elektromedizinische Geräte GmbH (AT), and Sonova Holding AG (CH) are at the forefront, each adopting distinct strategies to enhance their market positioning. For instance, Cochlear Limited (AU) emphasizes innovation in product development, focusing on next-generation cochlear implant technologies that integrate with digital platforms.

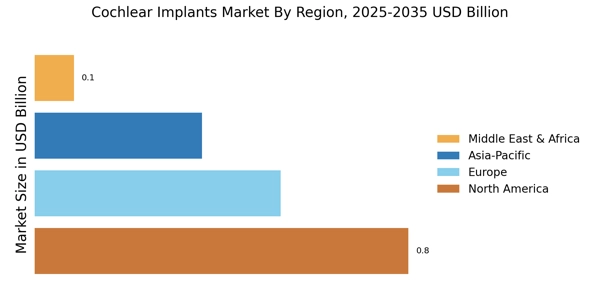

Meanwhile, Med-El Elektromedizinische Geräte GmbH (AT) is pursuing regional expansion, particularly in emerging markets, to capture a broader customer base. Sonova Holding AG (CH) appears to be leveraging strategic partnerships to enhance its product offerings and distribution channels, thereby shaping a competitive environment that is increasingly collaborative.

In terms of business tactics, companies are localizing manufacturing to reduce costs and optimize supply chains, which is particularly crucial in a moderately fragmented market. This approach not only enhances operational efficiency but also allows for quicker response times to market demands. The competitive structure is influenced by the collective actions of these key players, who are increasingly focusing on innovation and customer-centric solutions to differentiate themselves in a crowded marketplace.

In August 2025, Cochlear Limited (AU) announced the launch of a new wireless accessory designed to enhance the user experience for cochlear implant recipients. This strategic move is significant as it aligns with the growing trend of digital integration in healthcare, potentially increasing user satisfaction and adherence to treatment. The introduction of such innovative products may solidify Cochlear's market leadership and attract new customers seeking advanced solutions.

In September 2025, Med-El Elektromedizinische Geräte GmbH (AT) expanded its operations into Southeast Asia, establishing a new manufacturing facility in Vietnam. This expansion is strategically important as it not only reduces production costs but also positions the company to better serve the rapidly growing demand for cochlear implants in the region. By localizing production, Med-El is likely to enhance its competitive edge and responsiveness to market needs.

In July 2025, Sonova Holding AG (CH) entered into a strategic partnership with a leading technology firm to develop AI-driven solutions for hearing rehabilitation. This collaboration is indicative of the increasing integration of artificial intelligence in the healthcare sector, suggesting that Sonova is positioning itself at the cutting edge of technological advancements in hearing solutions. Such initiatives may enhance the efficacy of their products and improve patient outcomes, thereby reinforcing their market position.

As of October 2025, the Cochlear Implants Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming increasingly pivotal, as companies recognize the value of collaboration in driving innovation and expanding market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, enhanced user experiences, and reliable supply chains, reflecting a broader shift in the industry towards value-driven strategies.