Coating Pretreatment Market Summary

As per Market Research Future analysis, the Coating Pretreatment Market Size was estimated at 4.33 USD Billion in 2024. The Coating Pretreatment industry is projected to grow from 4.53 USD Billion in 2025 to 7.118 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.62% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Coating Pretreatment Market is poised for growth driven by sustainability and technological advancements.

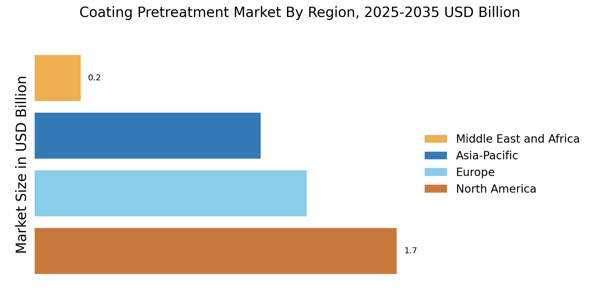

- The market is increasingly influenced by a strong focus on sustainability initiatives, particularly in North America.

- Technological advancements are reshaping the landscape, with innovations enhancing efficiency and performance in coating processes.

- The automotive sector is experiencing significant growth, contributing to the demand for effective pretreatment solutions, especially in steel applications.

- Rising demand for consumer electronics and expansion of construction activities are key drivers propelling the market forward, particularly in the chrome-free and aluminum segments.

Market Size & Forecast

| 2024 Market Size | 4.33 (USD Billion) |

| 2035 Market Size | 7.118 (USD Billion) |

| CAGR (2025 - 2035) | 4.62% |

Major Players

Henkel (DE), BASF (DE), PPG Industries (US), AkzoNobel (NL), Nippon Paint Holdings (JP), Kansai Paint (JP), Sherwin-Williams (US), 3M (US), Hempel (DK)