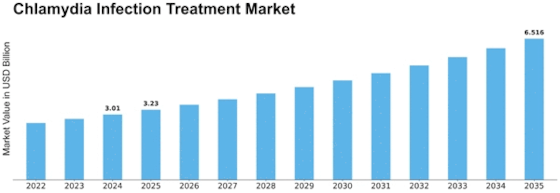

Chlamydia Infection Treatment Size

Chlamydia Infection Treatment Market Growth Projections and Opportunities

The market for Chlamydia infection treatment is closely linked to prevalence and incidence rates. The link is crucial. Since chlamydia is one of the most frequent sexually transmitted infections, effective and efficient alternative treatments are in demand.

Chlamydia infection therapy is being greatly impacted by advanced diagnostic tools. Accurate and fast diagnostic technologies are needed to detect illnesses sooner, leading to quick treatment and market development. Public awareness campaigns on chlamydia and other STDs affect market dynamics. Other STDs are addressed by these activities. Market growth is driven by healthcare organizations and government initiatives to educate the public about timely diagnosis and treatment. Regulatory frameworks and government funding affect the Chlamydia infection treatment business. Strong rules to ensure pharmaceutical safety and efficacy and financial help for research and development to encourage treatment innovation are needed. Both items are required. The emergence of antibiotic-resistant Chlamydia strains worries the market. Academics and pharmaceutical businesses are investigating new treatments to overcome resistance. Thus, the product market is becoming more competitive. The global healthcare and medication spending market is crucial to Chlamydia infection therapy. Economics and healthcare spending can affect the availability of alternative treatments and the uptake of new drugs. The market is growing because to therapeutic advances such new antibiotics and other treatments. Pharmaceutical companies invest in R&D to improve treatment efficacy, creating a dynamic industry. Telemedicine and digital health platforms have a huge impact on the chlamydia treatment business. These systems improve access to healthcare, simplify distant consultations, and speed up chlamydia treatment. Market trends are affected by patient preferences and treatment adherence. Patients' preferred treatment alternatives are expected to gain commercial acceptance. These treatments may have easier dosage or fewer negative effects. Partnerships between healthcare, research, and pharmaceutical firms drive industry growth. These collaborations are crucial to market growth. Partnerships accelerate clinical studies, increase research capacity, and help provide new Chlamydia treatments. Healthcare infrastructure, especially in poor nations, affects the chlamydia infection treatment industry. The patient pool is growing due to healthcare facility upgrades and increased access to doctors and services. Insurance coverage and payment rules affect chlamydia treatment cost and availability. Advantageous payment arrangements may drive market adoption, increasing patient treatment options.

Leave a Comment