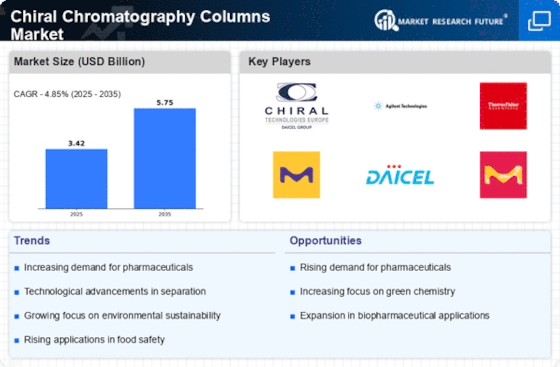

Market Share

Chiral Chromatography Columns Market Share Analysis

Establishing a strong market share position in the Chiral Chromatography Columns Market begins with investing in advanced column technologies. Companies should develop and offer columns with cutting-edge stationary phases, novel packing materials, and enhanced resolution capabilities for chiral separation. Building a comprehensive product portfolio is strategic. Companies can offer a diverse range of chiral chromatography columns catering to various applications, such as pharmaceuticals, food and beverages, and environmental analysis, ensuring relevance across different industries and research fields. Researchers that establish good collaborations with research centers well-up market positioning. The adoption of APHR could be noted in subordinate aspects as an active partnering approach to research and academic institutions for insight into evolving needs and trends within the chiral chromatography area that fosters innovation and out running competitors. It all depends on the customization possibility for a particular application. Companies will be able to produce customized chiral columns that suit the needs of the various industries thus ensuring the researchers get optimal separation in various chromatographic analyses. A key tactic is column optimization for high-throughput analysis. Chromatographic columns need to be designed keeping in mind that chiral separations can be accomplished quickly and reliably – these are the needs of laboratories requiring fast and accurate analytical results. Traditional business’ industry, expanding market share can mean venturing into new markets. Through these strategic partnerships, distribution agreements and companies having subsidiaries can go global not just expanding its reach to other countries but also have diversified business sizes. Quality assurance standards and regulatory compliance are not negotiable. Chiral chromatography columns should abide by standard parameters guaranteed by quality systems in most parts of the world, thus ensuring replicable and repeatable results in the affairs of customers. Create education and training programs as integral parts of the market growth. The company can run workshops, webinars and training opportunities to the researchers and chromatographers on the capabilities and ideal practices in the use of its chiral chromatography columns. Such strategic marketing is crucial to a solid brand presence. Market research shows that companies should invest their efforts into various brand awareness creation, product features demonstration, and discrimination on the mostly competitive market. A strategic partnership with chromatography instrument manufactures. Many companies enter into partnerships in further by filling with the chiral columns with the leading chromatography instruments, integration, companies provide customers with solutions. The important thing, though, is to keep responsive toward the developing innovations. Comprehension for maintaining the column range that would allow companies to provide suitable solutions that follow the technological advancement in chromatography instrumentation, data analysis software, and complementary technologies.

Providing excellent customer support is paramount. Companies should establish responsive customer service channels to address inquiries, offer technical assistance, and ensure customer satisfaction, fostering positive relationships and repeat business.

Leave a Comment