Economic Growth and Urbanization

China's ongoing economic growth and urbanization are pivotal factors influencing the remittance market. As urban areas continue to expand, more individuals migrate from rural regions in search of better employment opportunities. This trend is expected to drive remittance flows, as urban workers often send money back home to support their families. In 2025, it is anticipated that remittances will contribute significantly to the income of rural households, potentially accounting for up to 30% of their total income. This dynamic not only bolsters the remittance market but also highlights the interconnectedness of urban and rural economies.

Increased Awareness of Financial Services

The growing awareness of financial services among the Chinese population is significantly impacting the remittance market. As financial literacy improves, more individuals are recognizing the benefits of formal remittance channels over informal methods. This shift is likely to result in a decline in the use of unregulated services, which often come with higher fees and risks. By 2025, it is projected that the share of remittances processed through formal channels will rise to 85%, reflecting a broader acceptance of regulated financial services. This trend not only enhances the security of transactions but also contributes to the overall growth of the remittance market.

Regulatory Support for Financial Inclusion

Regulatory support aimed at enhancing financial inclusion is emerging as a crucial driver for the remittance market in China. The government has implemented various policies to facilitate easier access to financial services for underserved populations. Initiatives such as the establishment of digital banking platforms and simplified KYC (Know Your Customer) processes are likely to encourage more individuals to participate in the remittance market. By 2025, it is expected that these regulatory measures will lead to a 20% increase in the number of active remittance users, thereby expanding the market and fostering economic growth.

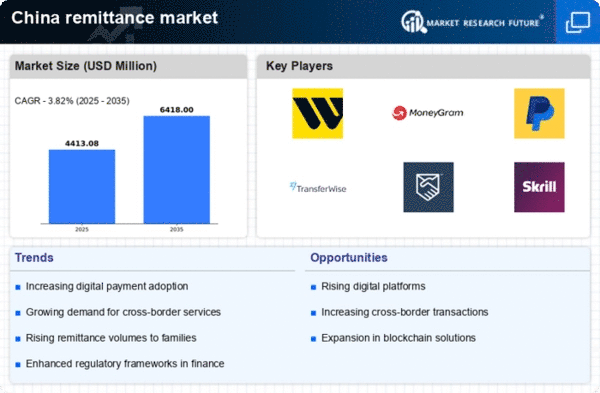

Growing Demand for Cross-Border Transactions

The demand for cross-border transactions is a significant driver of the remittance market in China. With millions of Chinese citizens working abroad, the need for efficient and cost-effective remittance services is paramount. In 2025, it is projected that remittances sent to China will exceed $100 billion, reflecting a growing reliance on these funds for family support and investment. This increasing demand is prompting service providers to enhance their offerings, leading to a more competitive landscape. Consequently, the remittance market is likely to evolve, with providers focusing on customer-centric solutions to capture a larger share of this expanding market.

Technological Advancements in Payment Systems

The remittance market in China is experiencing a notable transformation due to rapid technological advancements in payment systems. Innovations such as blockchain technology and mobile payment applications are streamlining cross-border transactions, enhancing security and efficiency. In 2025, it is estimated that mobile payments will account for over 70% of all remittance transactions in China. This shift not only reduces transaction costs but also increases accessibility for users, particularly in rural areas. As a result, the remittance market is likely to see a surge in participation from previously underserved demographics, thereby expanding its overall market size.