Urbanization Trends

Rapid urbanization in China is emerging as a crucial driver for the personal emergency-response-systems market. As more individuals migrate to urban areas, the density of the population increases, leading to a higher incidence of emergencies. Urban environments often present unique challenges, such as longer response times from emergency services due to traffic congestion. Consequently, there is a growing need for personal emergency-response systems that can provide immediate assistance. Market analysis indicates that urban areas are expected to account for a significant share of the market, with projections suggesting a growth rate of around 18% in urban centers. This trend underscores the necessity for reliable emergency response solutions tailored to the complexities of urban living, thereby propelling the personal emergency-response-systems market forward.

Aging Infrastructure

The aging infrastructure in many parts of China is likely to impact the personal emergency-response-systems market significantly. As infrastructure deteriorates, the risk of accidents and emergencies increases, necessitating the need for effective emergency response solutions. Older buildings and facilities may lack modern safety features, which can exacerbate emergency situations. This scenario creates a pressing demand for personal emergency-response systems that can provide timely assistance in critical situations. Market forecasts suggest that the demand for these systems could rise by approximately 12% as stakeholders recognize the importance of enhancing safety measures in aging infrastructures. Thus, the personal emergency-response-systems market is positioned to grow as a response to the challenges posed by aging infrastructure.

Rising Health Awareness

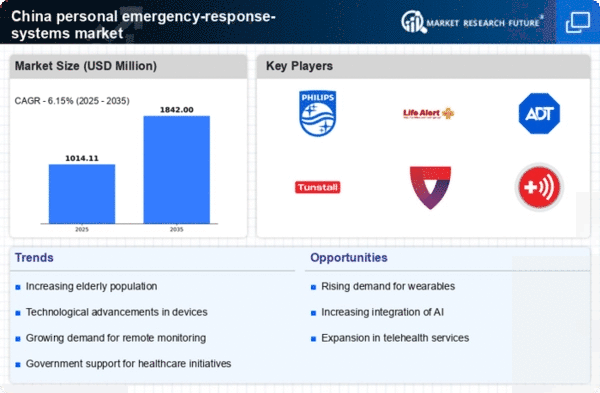

The increasing health consciousness among the population in China appears to be a pivotal driver for the personal emergency-response-systems market. As individuals become more aware of health risks and the importance of immediate medical assistance, the demand for personal emergency-response systems is likely to rise. This trend is particularly evident among urban populations, where access to healthcare services can be limited. Reports indicate that the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for timely medical intervention. Furthermore, the integration of health monitoring features in these systems may enhance their appeal, as consumers seek comprehensive solutions that address their health concerns. Thus, the personal emergency-response-systems market is poised to benefit from this heightened awareness and demand for proactive health management.

Technological Integration

The integration of advanced technologies into personal emergency-response systems is transforming the landscape of the market in China. Innovations such as artificial intelligence, machine learning, and IoT connectivity are enhancing the functionality and reliability of these systems. For instance, systems equipped with real-time location tracking and automated alerts can significantly improve response times during emergencies. The market is witnessing a surge in demand for smart devices that not only provide emergency assistance but also monitor health metrics. This technological evolution is expected to drive market growth, with estimates suggesting a potential increase in market size by over 20% in the next few years. As consumers increasingly seek sophisticated solutions that offer both safety and convenience, the personal emergency-response-systems market is likely to expand in response to these technological advancements.

Increased Disposable Income

The rise in disposable income among the Chinese population is contributing to the growth of the personal emergency-response-systems market. As individuals experience improved financial stability, they are more inclined to invest in personal safety and health solutions. This trend is particularly pronounced among middle and upper-income groups, who prioritize health and safety in their purchasing decisions. Market data indicates that the segment of consumers willing to spend on personal emergency-response systems is expanding, with an expected growth rate of around 10% in the coming years. This increase in disposable income allows consumers to seek out advanced emergency-response solutions, thereby driving the personal emergency-response-systems market forward. The correlation between economic growth and consumer spending on safety products suggests a promising outlook for the market.