China Egg Tray Packaging Size

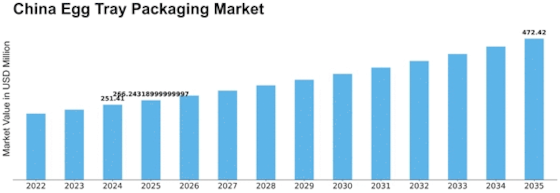

China Egg Tray Packaging Market Growth Projections and Opportunities

The China Egg Tray Packaging Market is influenced by a number of factors affecting its dynamics and growth. The largest among these is the size of egg production in China. As the world’s largest producer and consumer of eggs, the country’s massive poultry industry requires efficient and reliable packaging solutions. The rise in consumption of eggs locally and internationally has led to an increasing need for secure, sustainable ways of packaging them, thus boosting China’s egg tray packaging industry.

Additionally, there have been significant changes that have occurred through shifting from one lifestyle to another as well as dietary habits hence shaping the market too. There is a growing awareness on health and nutrition leading to increase demand for protein food like eggs which calls for a good packaging solution in order to retain its freshness and quality. Today buyers prefer purchasing eggs which are packed in trays since they can be transported easily without breaking hence influencing this market towards innovative and practical egg tray packing alternatives.

China Egg Tray Packaging Market trends are also often influenced by government policies and regulations. The Chinese administration has been instrumental in instituting measures aimed at improving food safety standards with regard to human health issues. This has seen increased attention paid to all types of food packaging including eggs. Therefore stringent rules have prompted manufacturers to use technology that will meet required standards for ensuring the safety of packed eggs itself . Thus it becomes important that regulation enforcement becomes one key determinant when assessing success or failure in the egg tray packaging sector within China.

Sustainability concern emphasized on it was also highlighted as being another beacon within this sphere; much like everywhere else across the globe, people come into realization about what type of imprint certain packing materials could leave on nature around us such as those found in china. Eco-friendly packages are gaining prominence whereby more consumers worldwide are buying biodegradable ones hence impacting material choice used for making egg trays. Packaging industries are now focusing their R&D towards creating alternative solutions that meet both global environmental trends and consumer preferences.

Moreover, the dynamics of China Egg Tray Packaging Market are shaped by competition in the industry and its consolidation. The sector is currently facing a lot of competition that has made it to embrace innovation as well as cost effectiveness. Acquisitions and mergers have become common practice in order to increase market share and provide more packaging options. This competitive environment pushes for continuous technology advancements and designs that benefit the overall growth path taken by the Chinese egg tray packing industry.

Furthermore, web-based retailing or e-commerce has changed the country’s packaging needs. More people buy eggs online hence there is a need for packing techniques that can withstand transportation and handling challenges within this supply chain. This has led to the demand for robust & protective egg tray packaging which will not only ensure safety but also facilitate consumers’ access thus impacting on these market forces.

Leave a Comment