Growing Investment from Private Sector

The digital healthcare market in China is experiencing a surge in investment from the private sector, which plays a crucial role in driving innovation and expansion. Venture capital funding for health tech startups has increased significantly, with investments reaching approximately $5 billion in 2025. This influx of capital allows companies to develop cutting-edge solutions that cater to the evolving needs of consumers. The digital healthcare market is thus becoming increasingly competitive, as new entrants introduce innovative products and services. This trend not only fosters a dynamic market environment but also encourages collaboration between technology firms and healthcare providers, ultimately enhancing the quality of care available to patients.

Increased Health Awareness and Education

The digital healthcare market in China is witnessing a rise in health awareness and education among the population. As individuals become more informed about health issues and preventive care, there is a growing inclination to utilize digital health solutions. Surveys indicate that over 70% of Chinese citizens actively seek health information online, which drives the demand for mobile health applications and telehealth services. This trend suggests that the digital healthcare market must focus on providing educational resources and tools that empower consumers to take charge of their health. By leveraging digital platforms, healthcare providers can enhance patient engagement and promote healthier lifestyles, ultimately contributing to improved public health outcomes.

Technological Advancements in Healthcare

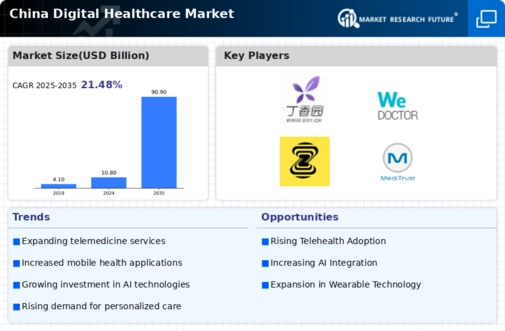

The digital healthcare market in China is significantly influenced by rapid technological advancements that enhance healthcare delivery. Innovations such as artificial intelligence, big data analytics, and wearable health devices are transforming the way healthcare services are provided. In 2025, the market for wearable health technology is projected to reach $10 billion, reflecting a growing consumer interest in health monitoring solutions. These advancements enable healthcare providers to offer personalized care and improve patient outcomes. The digital healthcare market is thus evolving, as stakeholders increasingly adopt these technologies to streamline operations and enhance service delivery. This trend indicates a promising future for the integration of technology in healthcare.

Government Initiatives and Policy Support

The digital healthcare market in China benefits significantly from robust government initiatives and policy support aimed at enhancing healthcare delivery. The Chinese government has implemented various policies to promote the adoption of digital health technologies, including financial incentives for healthcare providers and investments in digital infrastructure. In 2025, the government allocates approximately $2 billion to support the development of telemedicine and electronic health records. These initiatives not only facilitate the integration of technology into healthcare but also aim to improve health outcomes across the population. The digital healthcare market is thus positioned to thrive under this supportive regulatory environment, fostering innovation and encouraging the adoption of advanced healthcare solutions.

Rising Demand for Remote Healthcare Services

The digital healthcare market in China experiences a notable surge in demand for remote healthcare services. This trend is driven by an increasing population that seeks convenient access to medical consultations and follow-ups without the need for physical visits. As of 2025, approximately 60% of urban residents express a preference for telehealth options, indicating a shift in consumer behavior. The digital healthcare market is adapting to this demand by enhancing telemedicine platforms and integrating user-friendly interfaces. Furthermore, the Chinese government supports this transition by investing in digital infrastructure, aiming to improve healthcare accessibility in rural areas. This growing inclination towards remote services is likely to reshape the landscape of healthcare delivery, making it more efficient and patient-centric.