Market Trends

Key Emerging Trends in the China Automotive Industry Market

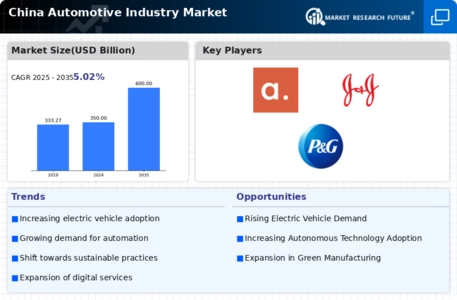

The automotive industry in China has undergone significant market trends, reflecting the country's rapid economic development and technological advancements. One notable trend is the increasing focus on electric vehicles (EVs). China has positioned itself as a global leader in the EV market, with government incentives and policies promoting the adoption of electric cars. The push towards green energy and environmental sustainability has led both domestic and international automakers to invest heavily in the development and production of electric vehicles, contributing to the overall growth of the automotive industry in China.

Smart connectivity is another prominent trend shaping the Chinese automotive market. With the rise of the Internet of Things (IoT) and artificial intelligence (AI), vehicles are becoming increasingly connected, offering advanced features such as in-car infotainment systems, autonomous driving capabilities, and real-time data monitoring. Chinese consumers, known for their tech-savvy preferences, are driving the demand for smart and connected vehicles, influencing automakers to integrate cutting-edge technologies into their products.

The concept of shared mobility has gained traction in China, driven by urbanization, changing consumer behaviors, and government initiatives. Car-sharing services and ride-hailing platforms have become integral parts of the automotive landscape, particularly in densely populated cities. Many Chinese consumers, especially in younger demographics, prefer the convenience and cost-effectiveness of shared mobility options over traditional car ownership. This shift in consumer preferences is reshaping the automotive industry's business models and influencing automakers to explore new avenues of collaboration with mobility service providers.

Innovation and collaboration in the automotive sector are contributing to the development of autonomous vehicles in China. The government has expressed a commitment to fostering the growth of autonomous driving technology, with various pilot projects and initiatives underway. Chinese automakers, as well as technology companies, are investing in research and development to bring self-driving vehicles to the market. The integration of advanced driver-assistance systems (ADAS) is a stepping stone towards achieving full autonomy, and these technologies are becoming increasingly common in vehicles across different price segments.

Government policies and regulations play a crucial role in shaping market trends in the Chinese automotive industry. China has implemented measures to encourage the production and consumption of new energy vehicles (NEVs), including electric and plug-in hybrid cars. These policies include subsidies, incentives, and regulations promoting the development of charging infrastructure. The government's commitment to reducing emissions and promoting sustainable transportation aligns with global efforts to address climate change, making China a key player in the green automotive revolution.

The shift towards digitalization and e-commerce has also influenced the automotive retail landscape in China. Online platforms for car sales, virtual showrooms, and digital marketing strategies have become essential for automakers to reach and engage with consumers. The rise of e-commerce in the automotive sector reflects the changing expectations of Chinese consumers, who increasingly prefer digital channels for researching, purchasing, and servicing their vehicles.

The market trends in the Chinese automotive industry are dynamic and multifaceted, driven by a combination of technological advancements, government policies, and changing consumer preferences. The emphasis on electric vehicles, smart connectivity, shared mobility, autonomous driving, and digitalization underscores the transformative nature of the industry. As China continues to play a leading role in the global automotive market, the trends discussed are likely to shape the future of the industry, with a continued focus on sustainability, innovation, and meeting the evolving needs of consumers in the world's largest automotive market.

Leave a Comment