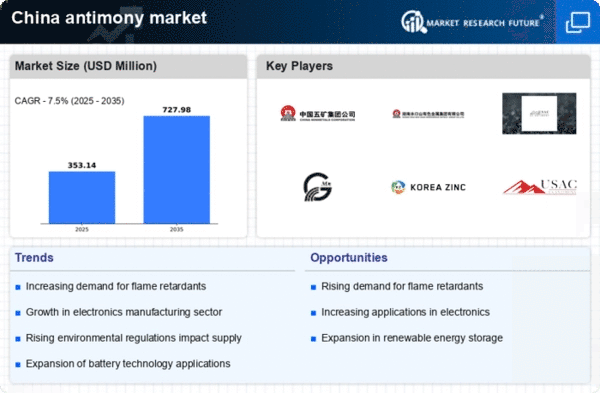

The antimony market exhibits a complex competitive landscape characterized by a mix of established players and emerging companies. Key growth drivers include increasing demand for antimony in flame retardants, lead-acid batteries, and electronics. Major companies such as China Minmetals Corporation (CN), Hunan Nonferrous Metals Corporation (CN), and Yunnan Tin Company Limited (CN) are strategically positioned to leverage their extensive resources and operational capabilities. China Minmetals Corporation (CN) focuses on vertical integration and expanding its mining operations, while Hunan Nonferrous Metals Corporation (CN) emphasizes technological advancements in refining processes. Yunnan Tin Company Limited (CN) is actively pursuing partnerships to enhance its supply chain efficiency, collectively shaping a competitive environment that is increasingly reliant on innovation and operational excellence.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to reduce costs and improve responsiveness to market demands. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of these key players suggests a trend towards consolidation, as companies seek to enhance their competitive positioning through strategic alliances and mergers.

In September Hunan Nonferrous Metals Corporation (CN) announced a joint venture with a leading technology firm to develop advanced antimony-based materials for the electronics sector. This strategic move is likely to bolster their product offerings and enhance their market presence, particularly in high-tech applications. The collaboration indicates a shift towards innovation-driven growth, aligning with global trends in electronics manufacturing.

In October Yunnan Tin Company Limited (CN) launched a new initiative aimed at increasing the sustainability of its antimony production processes. This initiative focuses on reducing carbon emissions and improving resource efficiency, reflecting a growing emphasis on environmental responsibility within the industry. Such actions may not only enhance their brand reputation but also position them favorably in a market increasingly driven by sustainability concerns.

In August China Minmetals Corporation (CN) completed the acquisition of a smaller antimony producer, which is expected to expand its production capacity and market reach. This acquisition underscores the trend of consolidation within the market, as larger players seek to enhance their operational capabilities and secure a more significant share of the growing demand for antimony.

As of November current competitive trends in the antimony market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming pivotal in shaping the landscape, as companies collaborate to innovate and enhance their operational efficiencies. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology integration, and supply chain reliability, indicating a transformative shift in how companies compete in this market.