Chillers Size

Chillers Market Growth Projections and Opportunities

Searching...

How much is the Chillers Market?

The Chillers Market size is expected to be valued at USD 15,374.0 Million in 2032.

What is the growth rate of the Chillers Market?

The global market is projected to grow at a CAGR of 4.5% during the forecast period, 2024-2032.

Which region held the largest market share in the Chillers Market?

Asia-Pacific had the largest share of the global market.

Who are the key players in the Chillers Market?

The key players in the market are Carrier Global Corporation, DAIKIN INDUSTRIES LTD, MITSUBISHI ELECTRIC CORPORATION, DIMPLEX THERMAL SOLUTIONS, LG Electronics, JOHNSON CONTROLS INTERNATIONAL PLC, Polyscience Inc, SMARDT CHILLER GROUP INC, THERMAX LTD., TRANE Technologies Plc, and others.

Which Product Type led the Chillers Market?

The Water-Cooled Chiller category dominated the market in 2023.

Which End User had the largest market share in the Chillers Market?

The others segment had the largest revenue share of the global market.

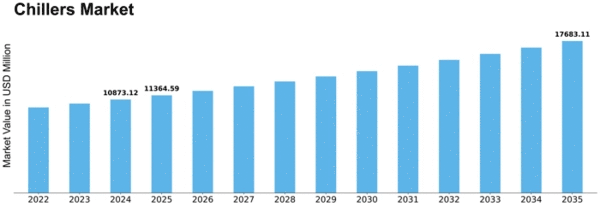

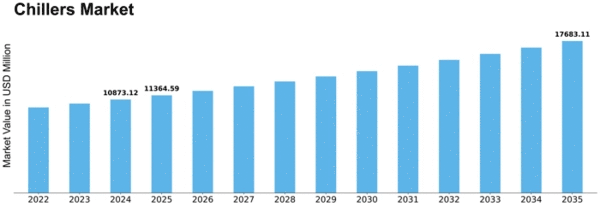

As per MRFR analysis, the Chillers Market Size was estimated at 10873.12 USD Million in 2024. The Chillers industry is projected to grow from 11364.61 in 2025 to 17683.11 by 2035, exhibiting a compound annual growth rate (CAGR) of 4.52 during the forecast period 2025 - 2035.

The Chillers Market is currently experiencing a transformative shift towards sustainability and technological integration.

| 2024 Market Size | 10873.12 (USD Million) |

| 2035 Market Size | 17683.11 (USD Million) |

| CAGR (2025 - 2035) | 4.52% |

| Largest Regional Market Share in 2024 | North America |

Carrier (US), Trane Technologies (IE), Daikin Industries (JP), Johnson Controls (US), Mitsubishi Electric (JP), Lennox International (US), York (US), Hitachi (JP), Gree Electric Appliances (CN), Haier (CN)

The Chillers Market is currently experiencing a dynamic evolution, driven by various factors including technological advancements and increasing energy efficiency demands. As industries and commercial establishments seek to optimize their cooling solutions, the market appears to be shifting towards more sustainable and eco-friendly options. This transition is likely influenced by stringent regulations aimed at reducing carbon footprints and enhancing energy conservation. Furthermore, the growing awareness of climate change impacts seems to be prompting businesses to invest in innovative chillers that not only meet operational needs but also align with environmental goals. In addition, the integration of smart technologies into chillers is becoming increasingly prevalent. This trend indicates a movement towards automation and remote monitoring, which enhances operational efficiency and reduces maintenance costs. As the Chillers Market continues to expand, it is essential for stakeholders to remain vigilant about emerging technologies and evolving consumer preferences. The interplay between sustainability and technological innovation is likely to shape the future landscape of this market, presenting both challenges and opportunities for manufacturers and end-users alike.

The Chillers Market is witnessing a pronounced shift towards sustainable solutions. Manufacturers are increasingly developing chillers that utilize environmentally friendly refrigerants and energy-efficient designs. This trend is largely driven by regulatory pressures and a growing commitment to reducing greenhouse gas emissions.

The incorporation of smart technologies into chillers is gaining traction. Features such as IoT connectivity and advanced monitoring systems are enhancing operational efficiency. This trend suggests that businesses are prioritizing automation to optimize performance and reduce energy consumption.

There is a rising demand for customized chillers tailored to specific industry needs. This trend indicates that businesses are seeking flexible solutions that can adapt to varying operational requirements, thereby enhancing overall efficiency and performance.

The Global Chillers Market Industry is experiencing a notable shift towards energy-efficient solutions. As energy costs continue to rise, businesses are increasingly seeking chillers that minimize energy consumption while maximizing cooling output. This trend is reflected in the projected market value of 10.9 USD Billion in 2024, driven by regulations promoting energy efficiency. Governments worldwide are implementing stringent energy efficiency standards, compelling manufacturers to innovate and produce advanced chillers that meet these requirements. Consequently, the demand for energy-efficient chillers is expected to grow, contributing to the overall expansion of the Global Chillers Market Industry.

The food and beverage sector is a critical driver of the Global Chillers Market Industry. With the increasing demand for processed and packaged foods, the need for efficient cooling towers in production and storage facilities is paramount. Chillers Market play a vital role in maintaining product quality and safety, particularly in temperature-sensitive items. As the global population continues to grow, the food and beverage industry is expected to expand, further driving the demand for chillers. This trend is likely to contribute to the overall market growth, with projections indicating a market value of 17.5 USD Billion by 2035, underscoring the significance of this sector in the Global Chillers Market Industry.

The Global Chillers Market Industry is significantly influenced by the ongoing trends of industrialization and urbanization. As urban areas expand and industries proliferate, the demand for effective cooling solutions rises correspondingly. This is particularly evident in developing regions where rapid urban growth necessitates robust infrastructure, including HVAC systems. The increasing number of commercial buildings and manufacturing facilities is expected to drive the market, with a projected CAGR of 4.45% from 2025 to 2035. This growth trajectory highlights the essential role of chillers in supporting the cooling needs of burgeoning urban centers, thereby reinforcing the Global Chillers Market Industry.

Technological innovation plays a pivotal role in shaping the Global Chillers Market Industry. The introduction of smart chillers equipped with IoT capabilities allows for real-time monitoring and optimization of cooling processes. These advancements not only enhance operational efficiency but also reduce maintenance costs. For instance, predictive maintenance technologies can identify potential failures before they occur, thereby minimizing downtime. As these technologies become more prevalent, they are likely to attract investments, further propelling the market. The anticipated growth in the market, reaching 17.5 USD Billion by 2035, underscores the importance of technological advancements in driving the Global Chillers Market Industry.

Regulatory frameworks promoting environmental sustainability are increasingly shaping the Global Chillers Market Industry. Governments are enacting policies aimed at reducing greenhouse gas emissions, which directly impacts the types of refrigerants used in chillers. The shift towards low-GWP (Global Warming Potential) refrigerants is becoming a standard requirement, compelling manufacturers to adapt their products accordingly. This regulatory support not only fosters innovation but also enhances market competitiveness. As the industry aligns with these environmental standards, it is likely to witness sustained growth, contributing to the projected market value of 10.9 USD Billion in 2024 and beyond.

In the Chillers Market, Commercial Cooling has emerged as the largest application segment, driven by the increased demand for energy-efficient cooling solutions in retail spaces, office buildings, and educational institutions. It significantly holds a larger market share compared to its counterparts, reflecting the growth of urban areas and the rise in construction activities that require effective cooling systems. Conversely, Industrial Cooling is recognized as the fastest-growing segment within the market, primarily fueled by the escalating demand in sectors such as manufacturing, food processing, and pharmaceuticals. The need for precise temperature control and enhanced operational efficiency in these industries has propelled the adoption of advanced cooling systems, thereby expanding the industrial segment rapidly.

Commercial Cooling (Dominant) vs. Process Cooling (Emerging)

The Commercial Cooling segment stands out as the dominant player in the Chillers Market, characterized by its extensive application across various commercial establishments. These chillers are engineered for efficient performance, affordability, and higher energy efficiency, making them ideal for retail shops and commercial buildings. On the other hand, Process Cooling emerges as an important sector, particularly in industries like pharmaceuticals and chemical processing where highly controlled cooling is mandatory. The technology advancements in process cooling systems, including the integration of IoT and automation, are rapidly transforming this segment, thus enhancing process efficiency and sustainability.

In the Chillers Market, the end-use segments show a diverse allocation of market share with Food and Beverage leading as the largest segment. This dominance is largely driven by the significant requirements for chilling systems to ensure proper storage and quality of perishable goods such as drinks and refrigerated foods. Following closely, Pharmaceuticals, which constitutes a smaller yet crucial segment due to the need for strict temperature control in drug development and storage, reflects emerging growth in this market.

Food and Beverage: Dominant vs. Pharmaceuticals: Emerging

The Food and Beverage sector remains the dominant force in the Chillers Market, primarily due to the escalation in consumer demand for fresh, chilled products. The industry necessitates advanced chillers for processing, storage, and transportation, ensuring that quality and safety standards are met. Conversely, the Pharmaceuticals segment is recognized as an emerging segment, propelled by the increasing adoption of chilled storage solutions and precise temperature management for sensitive drugs. This growth is driven by heightened regulatory requirements and the rising number of biopharmaceuticals that require stricter temperature controls, establishing a crucial niche in the overall market.

The Chillers Market is predominantly influenced by Water-Cooled Chillers, which command the largest share, favored for their efficiency in large-scale applications. Air-Cooled Chillers, while trailing in market share, are gaining traction due to the increasing demand for flexible and space-saving cooling solutions. Absorption and Reciprocating Chillers contribute to the diversity of offerings but occupy smaller segments, appealing primarily to niche applications. As the focus on energy efficiency intensifies, Water-Cooled Chillers remain the backbone of industrial cooling systems, whereas Air-Cooled Chillers are experiencing rapid adoption in smaller facilities. The market is also witnessing innovations in Absorption Chillers driven by renewable energy sources, and Reciprocating Chillers are favored for their compact size and reliability in varied environments.

Water-Cooled Chillers (Dominant) vs. Air-Cooled Chillers (Emerging)

Water-Cooled Chillers are recognized for their superior efficiency and performance in large-scale facilities, making them the go-to choice for industries that require robust cooling solutions. Their ability to operate continuously and integrate with centralized systems gives them an edge in energy consumption and cost-effectiveness, solidifying their position in the Chillers Market. In contrast, Air-Cooled Chillers are emerging rapidly due to the growing trends towards sustainability and the need for easier installation and maintenance. They provide flexibility in installation sites and are often preferred for smaller commercial applications. As these units become more efficient, they are seeing increased interest, especially in regions lacking adequate water supply, thereby diversifying the market landscape.

The Chillers Market showcases a distinct distribution of cooling capacities, with medium capacity chillers holding the largest market share. This segment significantly thrives due to their prevalence in commercial applications, providing optimal cooling for large buildings and industrial processes. Meanwhile, the large capacity chillers, while currently smaller in market share, are rapidly gaining traction as industries push to enhance their cooling efficiency and performance, indicating a shifting consumer preference towards larger systems.

Medium Capacity (Dominant) vs. Large Capacity (Emerging)

Medium capacity chillers dominate the market as they strike an ideal balance between size and cooling efficiency, catering to a diverse range of applications. Their versatility allows them to be utilized in both commercial and industrial sectors, making them a preferred choice among end-users. On the other hand, large capacity chillers are emerging rapidly, being recognized for their ability to handle high cooling loads efficiently. This growth is powered by rising demands in industrial processes requiring robust cooling solutions. While medium capacity chillers remain the go-to option for most applications, large capacity systems are poised to capture a larger share as they meet the evolving energy efficiency demands in the market.

In the Chillers Market, the distribution of control types reveals a strong preference for Automatic Control over Manual and Smart Control. Automatic Control systems hold the largest market share, attributed to their efficiency and reliability in temperature regulation, making them a staple in various industrial applications. In contrast, Manual Control, while still in use, is declining as businesses move towards more automated solutions to optimize performance and reduce operational costs.

Control Technology: Automatic (Dominant) vs. Smart (Emerging)

Automatic Control technology plays a dominant role in the Chillers Market due to its ability to seamlessly manage cooling performance through advanced sensors and programming. This technology facilitates energy efficiency and maintenance reduction, appealing to industries seeking long-term operational savings. On the other hand, Smart Control is rapidly becoming an emerging player, driven by the rise of IoT and smart building technologies. Smart Control systems offer enhanced features such as remote monitoring and predictive maintenance, appealing to tech-savvy consumers and environmentally conscious enterprises. As such, while Automatic Control remains established, Smart Control is set to reshape future market dynamics.

North America is poised to maintain its leadership in the chillers market, holding a significant share of $5450.0M in 2025. The region's growth is driven by increasing demand for energy-efficient cooling solutions, stringent environmental regulations, and advancements in technology. The push for sustainable practices and the adoption of smart building technologies are further catalyzing market expansion. The United States and Canada are the primary contributors to this market, with major players like Carrier, Trane Technologies, and Johnson Controls leading the charge. The competitive landscape is characterized by innovation and strategic partnerships, ensuring that North America remains at the forefront of the chillers market. The presence of established companies and a robust infrastructure supports continued growth and market resilience.

Europe's chillers market is projected to reach $3500.0M by 2025, driven by a strong focus on energy efficiency and sustainability. The European Union's regulations on refrigerants and energy consumption are pivotal in shaping market dynamics. The demand for eco-friendly chillers is on the rise, supported by government incentives and initiatives aimed at reducing carbon footprints. Leading countries such as Germany, France, and the UK are at the forefront of this market, with key players like Daikin Industries and Trane Technologies actively participating. The competitive landscape is marked by innovation and a shift towards integrated cooling solutions. As regulations tighten, companies are investing in R&D to develop compliant and efficient products, ensuring their market position in a rapidly evolving environment.

The Asia-Pacific Chillers Market, valued at 1500.0, is experiencing rapid growth, driven by urbanization and industrialization. Countries like China and India are witnessing a surge in demand for cooling solutions due to rising temperatures and increased construction activities. The region's focus on energy efficiency and sustainability is prompting investments in advanced chiller technologies. Government initiatives aimed at reducing energy consumption are also playing a crucial role in market expansion. China is the dominant player in the Asia-Pacific market, with significant contributions from local manufacturers such as Gree Electric Appliances and Haier Group. The competitive landscape is evolving, with both domestic and international players vying for market share. The increasing adoption of smart technologies in HVAC systems is further enhancing the growth prospects of the chillers market in this region. Companies are focusing on innovation to meet the diverse needs of consumers and comply with regulatory standards.

The Middle East and Africa chillers market is projected to reach $423.12M by 2025, driven by increasing demand for cooling solutions in the region's hot climate. The growth is supported by infrastructural developments and a rising population, leading to higher energy consumption. Governments are also investing in sustainable energy initiatives, which are expected to boost the adoption of energy-efficient chillers. Countries like the UAE and South Africa are leading the market, with key players such as Johnson Controls and Mitsubishi Electric establishing a strong presence. The competitive landscape is characterized by a mix of local and international companies, focusing on innovative solutions to meet the growing demand. As the region continues to develop, the chillers market is set for significant growth, driven by both residential and commercial sectors.

The Chillers Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for energy-efficient cooling solutions and stringent environmental regulations. Major players such as Carrier (US), Trane Technologies (IE), and Daikin Industries (JP) are at the forefront, each adopting distinct strategies to enhance their market positioning. Carrier (US) emphasizes innovation in energy-efficient technologies, while Trane Technologies (IE) focuses on sustainability and digital transformation. Daikin Industries (JP) is leveraging its global footprint to expand its product offerings, particularly in emerging markets. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and sustainability.Key business tactics within the Chillers Market include localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of products and services, catering to different customer needs while fostering competition among established and emerging companies.

In November Carrier (US) announced the launch of its new line of eco-friendly chillers designed to reduce energy consumption by up to 30%. This strategic move not only aligns with global sustainability goals but also positions Carrier as a leader in the energy-efficient segment of the market. The introduction of these chillers is expected to enhance Carrier's competitive edge, particularly in regions with stringent energy regulations.

In October Trane Technologies (IE) unveiled a partnership with a leading technology firm to integrate AI-driven analytics into its chillers. This collaboration aims to optimize performance and predictive maintenance, thereby reducing operational costs for customers. The strategic importance of this initiative lies in its potential to enhance customer satisfaction and loyalty through improved service offerings, which could lead to increased market share.

In September Daikin Industries (JP) expanded its manufacturing capabilities in Southeast Asia, investing approximately €50 million in a new facility. This expansion is significant as it not only increases production capacity but also allows Daikin to better serve the growing demand in the region. The strategic focus on local manufacturing is likely to enhance supply chain reliability and reduce lead times, further solidifying Daikin's competitive position.

As of December current trends in the Chillers Market indicate a strong emphasis on digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance innovation. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on technological innovation, sustainability, and supply chain reliability. This transition underscores the importance of adapting to market demands and regulatory pressures, positioning companies for long-term success.

In April 2024, Mitsubishi Electric introduces MECH-iF, an air-cooled chiller range featuring proprietary single screw compressors for enhanced energy efficiency and reliability.

In March 2024, Carrier introduced a new line of high-performance chillers tailored for data centres, featuring energy-saving technology and resilient operation. The AquaForce 30XF air-cooled screw chillers offer up to 50% energy savings with integrated hydronic free-cooling systems.

In March 2024, Daikin Applied unveils the enhanced Navigator WWV water-cooled screw chiller with an integrated heat recovery configuration, featuring low-global warming potential refrigerant R-513A, enabling significant energy savings and bolstering sustainability efforts in HVAC solutions.

The Chillers Market is projected to grow at a 4.52% CAGR from 2025 to 2035, driven by energy efficiency demands, technological advancements, and increasing cooling needs. The future of the Chillers Market is set for steady growth as global industries prioritize energy efficiency and decarbonization. Driven by the expansion of data centers and the food-processing sector, the market will increasingly adopt low-GWP refrigerants, magnetic bearing compressors, and IoT-enabled predictive maintenance systems.

New opportunities lie in:

By 2035, the Chillers Market is expected to achieve robust growth, reflecting evolving industry demands.

| MARKET SIZE 2024 | 10873.12(USD Million) |

| MARKET SIZE 2025 | 11364.61(USD Million) |

| MARKET SIZE 2035 | 17683.11(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 4.52% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Million |

| Key Companies Profiled | Carrier (US), Trane Technologies (IE), Daikin Industries (JP), Johnson Controls (US), Mitsubishi Electric (JP), Lennox International (US), York (US), Hitachi (JP), Gree Electric Appliances (CN), Haier (CN) |

| Segments Covered | Application, End Use, Chiller Type, Cooling Capacity, Control Type |

| Key Market Opportunities | Integration of energy-efficient technologies and smart controls in the Chillers Market presents substantial growth opportunities. |

| Key Market Dynamics | Rising demand for energy-efficient chillers drives innovation and competition among manufacturers in the market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

How much is the Chillers Market?

The Chillers Market size is expected to be valued at USD 15,374.0 Million in 2032.

What is the growth rate of the Chillers Market?

The global market is projected to grow at a CAGR of 4.5% during the forecast period, 2024-2032.

Which region held the largest market share in the Chillers Market?

Asia-Pacific had the largest share of the global market.

Who are the key players in the Chillers Market?

The key players in the market are Carrier Global Corporation, DAIKIN INDUSTRIES LTD, MITSUBISHI ELECTRIC CORPORATION, DIMPLEX THERMAL SOLUTIONS, LG Electronics, JOHNSON CONTROLS INTERNATIONAL PLC, Polyscience Inc, SMARDT CHILLER GROUP INC, THERMAX LTD., TRANE Technologies Plc, and others.

Which Product Type led the Chillers Market?

The Water-Cooled Chiller category dominated the market in 2023.

Which End User had the largest market share in the Chillers Market?

The others segment had the largest revenue share of the global market.

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment