Chemical Logistics Size

Chemical Logistics Market Growth Projections and Opportunities

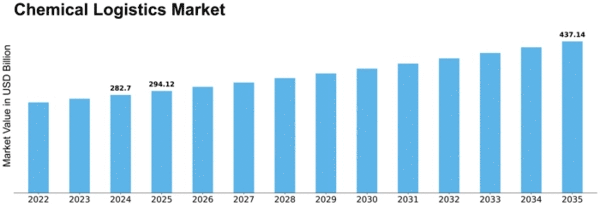

The global chemical logistics market is accounted to register a CAGR of 4.20% during the forecast period and is estimated to reach USD 380.1 billion by 2032.

The Chemical Logistics market is subject to a variety of market factors that collectively shape its dynamics and growth. One critical factor is the global chemical industry's demand, including the production and distribution of chemicals for various sectors such as manufacturing, agriculture, and healthcare. The intricate supply chain requirements and specific handling needs of chemicals create a specialized niche within the logistics industry. The demand for chemical logistics services is closely tied to the production volumes and geographical distribution of chemical manufacturing facilities worldwide.

Technological advancements play a significant role in shaping the Chemical Logistics market. The integration of advanced technologies such as GPS tracking, real-time monitoring, and data analytics enhances the efficiency, visibility, and safety of chemical transportation. The adoption of digital platforms for inventory management and order processing streamlines logistics operations, allowing for more precise tracking of chemical shipments. Companies in the chemical logistics sector must invest in and leverage these technologies to ensure the secure and timely movement of chemical products.

Environmental considerations are increasingly influential in the market for chemical logistics. Given the nature of chemical products, there is a growing emphasis on adopting sustainable and environmentally friendly practices. Companies in the chemical logistics market are investing in measures to reduce carbon emissions, optimize transportation routes for fuel efficiency, and ensure the safe disposal and handling of hazardous materials. Sustainability initiatives not only align with regulatory requirements but also contribute to a positive corporate image.

Regulatory compliance is a critical factor in the Chemical Logistics industry. The transportation and handling of chemicals are subject to a complex web of international, national, and local regulations governing safety, security, and environmental protection. Companies must navigate compliance with hazardous materials regulations, transportation safety standards, and chemical labeling requirements to ensure the legality and safety of their operations. Adherence to regulatory standards is not only a legal requirement but also an essential aspect of maintaining the integrity of the chemical logistics supply chain.

Global trade patterns and geopolitical factors also play a significant role in the Chemical Logistics market. The distribution of chemical manufacturing facilities worldwide and the interdependence of the global economy mean that changes in trade policies, tariffs, and geopolitical tensions can impact the logistics of chemical products. Companies in the chemical logistics sector must navigate international trade dynamics and geopolitical complexities to ensure the reliable and secure movement of chemicals across borders.

Market competition is intense within the Chemical Logistics sector. Companies vie for market share by offering specialized services, including the handling of hazardous materials, compliance expertise, and efficient transportation solutions. The ability to provide end-to-end logistics solutions, including warehousing, packaging, and distribution, is crucial for success. Additionally, forming strong partnerships with chemical manufacturers, regulatory bodies, and transportation providers is a common strategy for companies seeking a competitive edge in this complex and specialized market.

The nature of chemical products also makes safety and security paramount in the Chemical Logistics market. Companies must invest in training programs, security measures, and emergency response protocols to mitigate the risks associated with the transportation and handling of hazardous materials. Establishing a strong safety culture is not only a regulatory requirement but also a fundamental aspect of building trust with clients and ensuring the well-being of logistics personnel.

Leave a Comment