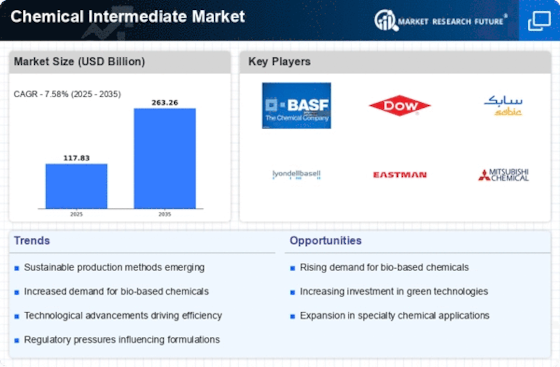

Top Industry Leaders in the Chemical Intermediate Market

The chemical intermediate market, a complex web of countless molecules fueling diverse end-use industries, pulsates with constant innovation and fierce competition. Understanding this landscape requires a closer look at the strategies shaping market share, industry news, and recent developments from the past six months.

The chemical intermediate market, a complex web of countless molecules fueling diverse end-use industries, pulsates with constant innovation and fierce competition. Understanding this landscape requires a closer look at the strategies shaping market share, industry news, and recent developments from the past six months.

Market Share Contenders and Their Strategies:

-

Global Chemical Giants: BASF, DowDuPont, and ExxonMobil Chemical dominate the market with diversified portfolios, extensive production networks, and R&D prowess. Their strategy hinges on economies of scale, vertical integration, and targeted acquisitions to consolidate market share. BASF's recent acquisition of Solvay's polyamide business exemplifies this, strengthening their nylon intermediates portfolio. -

Regional Heavyweights: Companies like INVISTA in the US and SI Group in Asia Pacific pose stiff competition in specific segments. INVISTA's nylon 6,6 intermediates leadership strengthens its foothold in textile applications, while SI Group's focus on specialty intermediates and strategic partnerships with downstream players fuels its regional growth. -

Nimble Innovators: Smaller, agile players like Biosynth and R K Synthesis carve niches through specialized high-purity intermediates and custom synthesis capabilities. Their focus on emerging applications like pharmaceuticals and fine chemicals fuels their growth, despite limited production capacities.

Factors Shaping Market Share:

-

Product Diversification: The ability to offer a comprehensive range of intermediates across various functionalities and applications proves crucial. Companies like DowDuPont excel in this aspect, catering to diverse industries like pharmaceuticals, cosmetics, and electronics. -

Technological Prowess: Continuous investment in R&D for efficient and sustainable production processes differentiates leaders. BASF's development of bio-based intermediates and DowDuPont's focus on catalyst technologies are prime examples. -

Regional Expansion: Capitalizing on the burgeoning demand from Asia Pacific and emerging economies like India and Brazil is key. SI Group's aggressive expansion in China and INVISTA's joint ventures in India exemplify this strategy. -

Sustainability Focus: Growing environmental concerns compel companies to adopt green technologies and offer eco-friendly intermediates. BASF's bio-based propylene glycol production and DowDuPont's renewable energy initiatives illustrate this trend.

Key Companies in the Chemical Intermediate market include

- Deepak Nitrite Ltd.

- BASF SE

- Rossari Biotech Ltd.

- INVISTA Nylon Chemical Co. Ltd.

- Stepan Company

- LG Royal DSM

- Chevron Corporation

- Himalaya Chemicals

- Akzo Nobel NV

Recent Developments:

March 2022: KaraMD announced Pure Health Apple Cider Vinegar Gummies, a vegan gummy aimed to aid ketosis, digestion regulation, weight management and encourage greater energy levels.

July 2021: Rossari Biotech Ltd, a specialty chemicals manufacturer, announced the aim to acquire Tristar Intermediates Pvt. Ltd. Rossari. According to the subject to customary closing conditions and the agreement terms, they will acquire all the equity share capital of Tristar Intermediates.

February 2020: The construction of the adiponitrile plant was started by INVISTA Nylon Chemicals Co., Ltd at the Shanghai chemical industry park with 400,000 tons per year. This more than 7 billion RMB investment will assist in meeting the increasing requirement for nylon 6,6 chemicals intermediates in China and the Asia Pacific region.

A research group from Nagoya University in Japan in April 2023 has managed to set up an effective synthesis of indole derivatives that are part of most drugs which therefore paves the way for the development of new therapeutic candidates.

Aarti Industries Limited and UPL Limited, which are in a joint venture of 50/50 in May 2024, seek to produce and sell specialized chemicals applicable to various downstream industries.