Market Trends

Key Emerging Trends in the Ceramic Package Market

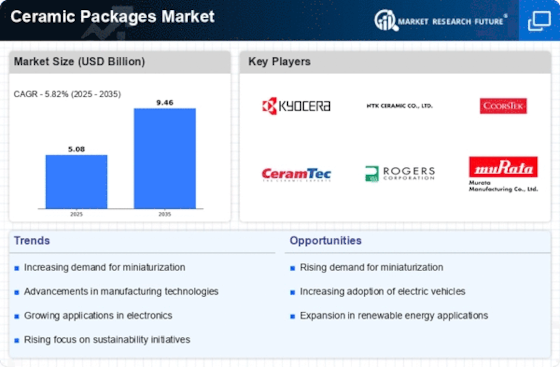

The Ceramic Packages market is witnessing significant trends, reflecting the dynamic landscape of the electronics and semiconductor packaging industry. Ceramic packages, known for their durability, thermal conductivity, and electrical insulation properties, play a crucial role in protecting semiconductor devices and ensuring their reliable performance. Several key trends are shaping the current trajectory of the Ceramic Packages market.

One notable trend in the Ceramic Packages market is the increasing demand for miniaturization in electronic devices. As consumer electronics, automotive systems, and industrial applications continue to shrink in size, there is a growing need for smaller and more compact semiconductor packages. Ceramic packages are well-suited for miniaturization efforts due to their excellent thermal properties, allowing for efficient heat dissipation in confined spaces.

The automotive industry is emerging as a key driver for the Ceramic Packages market. The proliferation of electronic components in modern vehicles, including advanced driver-assistance systems (ADAS), infotainment systems, and power electronics, necessitates reliable and robust packaging solutions. Ceramic packages offer the required durability and thermal management, making them a preferred choice for semiconductor devices in automotive applications.

The demand for high-frequency and high-power electronic devices is influencing the Ceramic Packages market. As the telecommunications, aerospace, and defense sectors continue to advance, there is a need for semiconductor packages capable of handling higher frequencies and power levels. Ceramic packages, with their superior electrical properties and thermal conductivity, address these requirements, supporting the development of high-performance electronic systems.

The Asia-Pacific region is a significant player in the global Ceramic Packages market. Countries such as China, Japan, and South Korea are major contributors to the semiconductor and electronics manufacturing industries. The region's rapid industrialization and technological advancements drive the demand for ceramic packages, particularly in applications ranging from consumer electronics to industrial automation.

Technological advancements in ceramic materials and packaging technologies are shaping trends in the Ceramic Packages market. Ongoing research and development efforts focus on enhancing the performance of ceramic packages through innovations such as advanced materials, precision manufacturing techniques, and improved sealing methods. These advancements contribute to the overall reliability and functionality of semiconductor devices.

The 5G rollout is influencing the Ceramic Packages market, especially in the telecommunications sector. The deployment of 5G networks requires semiconductor devices with higher data transfer rates and increased power handling capabilities. Ceramic packages, with their ability to support high-frequency applications and efficient thermal management, are well-suited for the demands of 5G infrastructure and devices.

Environmental considerations are becoming increasingly important in the Ceramic Packages market. As sustainability gains prominence across industries, there is a focus on developing environmentally friendly packaging solutions. Ceramic packages, known for their long lifespan and recyclability, align with sustainability goals, and manufacturers are exploring ways to optimize the environmental impact of ceramic packaging materials.

The semiconductor industry's shift towards advanced packaging technologies is impacting the Ceramic Packages market. Trends such as system-in-package (SiP) and 3D packaging architectures require packaging solutions that can accommodate multiple components in a compact form factor. Ceramic packages, with their versatility and thermal performance, play a crucial role in supporting these advanced packaging techniques.

Customization and flexibility are key trends in the Ceramic Packages market. Semiconductor manufacturers are seeking packaging solutions that can be tailored to specific device requirements. Customized ceramic packages, with variations in sizes, shapes, and thermal properties, enable semiconductor companies to address diverse application needs and achieve optimal performance.

Fluctuations in raw material prices, particularly those related to advanced ceramics, impact the Ceramic Packages market. The availability and cost of materials such as alumina and aluminum nitride influence the overall cost structure of ceramic package production. Market participants are closely monitoring these raw material dynamics to manage potential cost fluctuations and maintain competitiveness.

Leave a Comment