Ceramic Ball Size

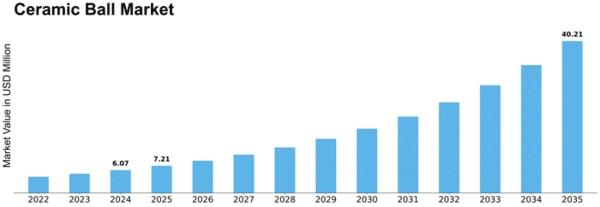

Ceramic Ball Market Growth Projections and Opportunities

The Ceramic Ball Market is influenced by various factors that contribute to its growth and dynamics. One of the primary drivers is the widespread use of ceramic balls in industries such as automotive, chemical, and aerospace. Ceramic balls, known for their hardness, resistance to corrosion, and durability, find applications in bearings, valves, and other critical components. The increasing demand for high-performance and wear-resistant materials in industrial applications propels the ceramic ball market.

Raw material availability and pricing are critical factors affecting the ceramic ball market. The primary raw materials for ceramic balls include alumina, zirconia, silicon nitride, and others, each with its unique properties. Fluctuations in the prices of these raw materials, influenced by factors like mining costs and supply-demand dynamics, directly impact the production costs of ceramic balls. The availability of high-quality raw materials is essential for maintaining the desired characteristics and performance of ceramic ball products.

Technological advancements in ceramic ball manufacturing processes significantly impact the market. Innovations in forming techniques, precision machining, and sintering technologies lead to the development of ceramic balls with improved strength, accuracy, and surface finish. Continuous research and development contribute to expanding the applications of ceramic balls in various industries. Companies investing in cutting-edge technologies can gain a competitive advantage by offering advanced and specialized ceramic ball products.

End-user industries, particularly automotive and aerospace, significantly influence the demand for ceramic balls. The automotive sector, where ceramic balls are used in bearings for their high performance and longevity, contributes significantly to the market's expansion. Similarly, the aerospace industry's demand for lightweight and high-strength materials, including ceramic balls in aerospace bearings, influences the overall market dynamics. Companies in the ceramic ball sector need to stay attuned to the trends and requirements of these key end-user industries to align their strategies with market demands.

Global economic conditions and trade policies also play a role in shaping the ceramic ball market. Changes in international trade agreements, tariffs, and geopolitical factors can influence the supply chain, affecting both producers and consumers. Companies in the market must navigate these global economic dynamics to ensure stability in their operations and to tap into emerging markets.

Consumer preferences for high-performance and durable products influence the ceramic ball market. As industries and consumers seek materials with enhanced properties, ceramic balls gain popularity in various applications where wear resistance and reliability are crucial. Companies that focus on product development, quality assurance, and customization to meet specific industry needs can attract a broader consumer base.

Environmental considerations and sustainability are becoming increasingly important in the ceramic ball market. Consumers and industries are placing a greater emphasis on environmentally friendly and recyclable materials. Ceramic balls, known for their longevity and resistance to wear, align well with sustainability goals. Companies adopting green manufacturing processes and promoting the eco-friendly aspects of ceramic balls can gain a competitive edge in the market.

Weather conditions and natural disasters can also influence the ceramic ball market, particularly in regions where manufacturing facilities are vulnerable to climate-related challenges. Unforeseen weather events, such as earthquakes or extreme temperatures, may disrupt production processes and impact the supply chain. Companies operating in these regions need to have contingency plans to address these weather-related factors.

Leave a Comment