- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

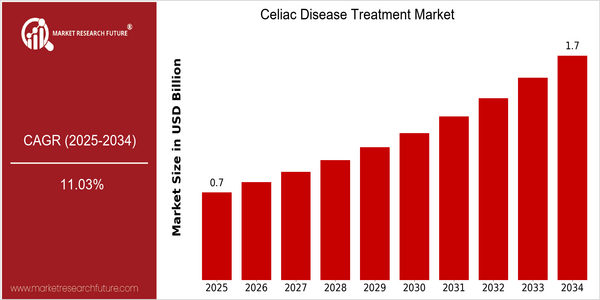

Celiac Disease Treatment Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 0.68 Billion |

| 2034 | USD 1.74 Billion |

| CAGR (2025-2034) | 11.03 % |

Note – Market size depicts the revenue generated over the financial year

The market for celiac disease treatment is expected to reach $1.74 billion by 2034, at a CAGR of 11.03% from 2018 to 2034. This upward trend is due to the increased awareness and diagnosis of celiac disease and the growing demand for effective treatment and dietary management. Celiac disease is a lifelong condition, and as more health care professionals and patients become aware of the condition, the market for celiac disease treatment is expected to grow rapidly. There are several factors driving this growth, including advances in medical research, the development of new therapies, and the rising prevalence of celiac disease worldwide. In addition, the technological trends toward the development of gluten-free food products and the use of individualized medicine are expected to boost the market. GlaxoSmithKline, Pfizer, and Alvine are all launching new products to keep up with the demands of the market. These efforts are expected to boost the market and improve the treatment of celiac disease.

Regional Deep Dive

The Celiac Disease Management Market is characterized by the rising awareness of celiac disease and the increasing demand for gluten-free products in different regions. In North America, the market is driven by a high prevalence of celiac disease and a strong health care system that supports the use of new treatment options. Europe has a strong regulatory framework that encourages the use of gluten-free labeling, while Asia-Pacific is seeing an increase in the diagnosis of celiac disease and the awareness of dietary needs. The Middle East and Africa (MEA) region faces unique challenges due to the variability in access to health care, but the interest in gluten-free diets is also increasing. Latin America is also a growing market due to the growing health consciousness of consumers. In general, the dynamics of the market are influenced by the culture of health, the regulatory framework, and the availability of treatment options.

North America

- The stricter the rules on gluten-free labeling, the more consumers trust these products, and the more they buy them.

- General Mills and Kellogg's are increasing their gluten-free ranges in response to the growing demand for gluten-free foods.

- According to recent studies, 1 in 100 people in the United States suffers from celiac disease, which has led to a rise in awareness and diagnosis.

Europe

- The European Food Safety Authority (EFSA) has established clear guidelines on labelling gluten-free foods, which have greatly increased market transparency.

- Glutan-free products from Dr. Schär and Glutafin are being developed to meet the wide variety of dietary requirements in Europe.

- In Italy and Germany, the gluten-free diet is well established and there are a lot of people who are willing to change their habits for the sake of celiacs.

Asia-Pacific

- Celiac disease is becoming more common in some countries, such as Japan and Australia, and medical attention is turning to better diagnosis and treatment.

- Local companies such as Gluten Free Foods Australia are developing new gluten-free products that are tailored to the local tastes and preferences.

- Celiac disease is now being recognized by the Indian government, which is expected to lead to greater awareness and thus to a potential increase in the market.

MEA

- Depending on the country, access to health care is variable, affecting the diagnosis and treatment of celiac disease, but the interest in gluten-free diets is increasing among urban populations.

- It is not to be forgotten that, although celiac disease is common in South Africa, it is still very little known in the United Arab Emirates. The Celiac Disease Foundation is doing a lot to raise awareness and to make the public aware of celiac disease.

- The traditional cuisine of a region may be a determining factor in the acceptance of gluten-free products.

Latin America

- Among the countries where the health consciousness is on the rise, Brazil and Argentina, for example, there is an increase in demand for gluten-free products and treatments.

- In the same way, in the gluten-free field, the local industry is beginning to take action. Brands such as schar have come to market to meet the growing demand.

- The regulations are still under development, but there is a need for clearer labeling and more information campaigns to educate consumers about celiac disease.

Did You Know?

“There is a considerable opportunity for the improvement of knowledge and treatment in the celiac disease market.” — Celiac Disease Foundation

Segmental Market Size

The celiac disease treatment market is primarily categorized into pharmaceutical treatment, dietary management and diagnostic tools. The pharmaceutical treatment segment is currently the most stable one. The main driving forces for this segment are the increasing prevalence of celiac disease, the growing awareness of consumers towards gluten-related disorders, and the ongoing research and development to improve the treatment. The approval of new therapies by regulatory authorities, such as the FDA, further stimulates the demand for the products, as it gives patients more options to manage their condition.

At present the use of drugs is in a stage of expansion, and companies like Takeda and Alvine are bringing out new therapies. The main application is the use of digestive enzymes to help the body digest gluten. The other main application is the production of gluten-free foods to meet the growing demand. The trend towards tele-medicine and a growing interest in personalised medicine is bringing this field of treatment to a new stage of development. Genetic tests and tele-medical applications will help to ensure that the treatment is more precise and individualised.

Future Outlook

The Celiac Disease Market is estimated to reach $68.6 million by 2025 and $174.0 million by 2034, with a CAGR of 11.03%. This growth is mainly due to the high prevalence of celiac disease in developed countries, which is about 1% of the population. Awareness of the disease increases and diagnostics improve, which means that more people will seek treatment, which will increase market penetration. By 2034, the treatment market is expected to have reached a penetration of about 25%, up from the estimated 10% in 2025, as health care professionals increasingly recognize the importance of early diagnosis and treatment of celiac disease.

In the coming years, technological advances, especially in the development of gluten-free products and in the emergence of new therapies, will play a crucial role in determining the size and structure of the market. The introduction of new drugs, enzymatic treatments and biologicals that can mitigate the effects of gluten on the body, will enhance the treatment options available to patients and thus further expand the market. As a matter of fact, the growing political and financial support for research into the disease will speed the development of new treatments. The growing demand for gluten-free foods and the increasing use of individualized medicine will also help the market grow. As the celiac disease treatment market develops, all players must be ready to seize opportunities and address the unmet needs of patients.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.5 Billion |

| Market Size Value In 2023 | USD 0.55 Billion |

| Growth Rate | 11.03% (2023-2032) |

Celiac Disease Treatment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.