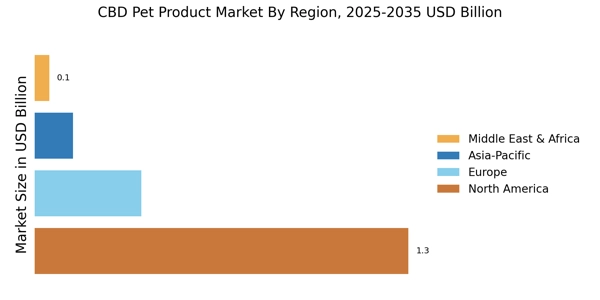

North America : Market Leader in CBD Pet Products

North America is the largest market for CBD pet products, holding approximately 70% of the global market share. The region's growth is driven by increasing pet ownership, rising awareness of CBD benefits, and favorable regulatory changes. The U.S. leads this market, followed by Canada, which is experiencing a surge in demand for natural pet wellness products. Regulatory support, including the 2018 Farm Bill, has catalyzed market expansion, allowing for broader product availability and consumer acceptance.

The competitive landscape in North America is robust, featuring key players such as Charlotte's Web, Pet Releaf, and HolistaPet. These companies are leveraging innovative marketing strategies and product diversification to capture market share. The presence of established brands and a growing number of startups contribute to a dynamic market environment. As consumer preferences shift towards natural and organic products, the demand for CBD-infused pet items is expected to continue its upward trajectory.

Europe : Emerging Market for CBD Products

Europe is rapidly emerging as a significant player in the CBD pet product market, currently holding about 20% of the global share. The growth is fueled by increasing pet ownership, a shift towards natural remedies, and evolving regulations that support CBD use in pet care. Countries like Germany and the UK are at the forefront, with progressive policies that encourage product development and consumer education. The European Food Safety Authority (EFSA) is actively working on guidelines to ensure product safety and efficacy, which is expected to further boost market growth.

Leading countries in Europe include Germany, the UK, and France, where consumer demand for CBD pet products is on the rise. The competitive landscape features both established brands and new entrants, with companies like Canna-Pet and Joy Organics gaining traction. The market is characterized by a diverse range of products, including oils, treats, and supplements, catering to various pet needs. As regulations become clearer, the market is poised for significant expansion.

Asia-Pacific : Emerging Powerhouse in Pet Care

The Asia-Pacific region is witnessing a burgeoning interest in CBD pet products, currently holding around 7% of the global market share. This growth is driven by increasing pet ownership, rising disposable incomes, and a growing awareness of the benefits of CBD for pets. Countries like Australia and New Zealand are leading the charge, with favorable regulations and a growing acceptance of CBD in pet care. The region's market is expected to expand significantly as consumer education improves and product availability increases.

In Asia-Pacific, the competitive landscape is evolving, with both local and international players entering the market. Companies like King Kanine and CBDfx are establishing a presence, focusing on high-quality, natural products. The demand for CBD-infused pet treats and supplements is on the rise, reflecting a broader trend towards holistic pet care. As the market matures, innovation and quality assurance will be key factors in capturing consumer trust and loyalty.

Middle East and Africa : Developing Market for CBD Products

The Middle East and Africa (MEA) region is in the early stages of developing its CBD pet product market, currently holding about 3% of the global share. The growth potential is significant, driven by increasing pet ownership and a gradual shift towards natural health products. Countries like South Africa are beginning to explore the benefits of CBD for pets, with regulatory frameworks slowly evolving to accommodate these products. As awareness grows, the market is expected to expand, albeit at a slower pace compared to other regions.

In the MEA region, the competitive landscape is still emerging, with a few local players starting to introduce CBD pet products. The focus is primarily on educating consumers about the benefits of CBD and ensuring product safety. As regulations become more defined, opportunities for international brands to enter the market will increase. The demand for CBD-infused pet products is anticipated to grow as pet owners seek natural alternatives for their pets' health and wellness.