Top Industry Leaders in the Cathode Materials Market

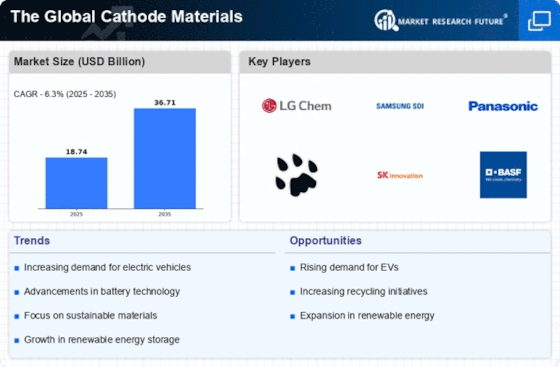

The cathode materials market, a crucial component of the booming battery industry, is experiencing fierce competition driven by the surging demand for electric vehicles and energy storage solutions. This document delves into the market landscape, highlighting strategies adopted by key players, factors influencing market share, recent industry news, and developments observed in the past six months.

The cathode materials market, a crucial component of the booming battery industry, is experiencing fierce competition driven by the surging demand for electric vehicles and energy storage solutions. This document delves into the market landscape, highlighting strategies adopted by key players, factors influencing market share, recent industry news, and developments observed in the past six months.

Strategies Shaping the Market:

-

Innovation and R&D: Companies are heavily investing in research and development to create high-performance cathode materials with increased energy density, rapid charging capabilities, and improved safety. -

Diversification: Players are expanding their product offerings to cater to different battery types and applications, like LFP (lithium iron phosphate) for long-lasting energy storage and NMC (nickel-manganese-cobalt) for high-energy electric vehicles. -

Vertical Integration: Integrating upstream mining and refining operations with downstream cathode production ensures supply chain stability and cost control. -

Partnerships and Collaborations: Forming strategic alliances with battery manufacturers, automakers, and research institutions accelerates innovation and market access. -

Sustainability Focus: Consumers and regulators are increasingly emphasizing ethical sourcing and environmentally friendly production processes, prompting companies to adopt sustainable practices.

Factors Influencing Market Share:

-

Cost Competitiveness: Efficient manufacturing processes, access to raw materials, and economies of scale play a crucial role in determining profit margins and customer acquisition. -

Technological Advancement: Developing next-generation cathode materials with superior performance can offer a significant competitive edge. -

Geographical Presence: Establishing production facilities in strategic locations close to key markets and raw material sources minimizes logistic costs and ensures timely delivery. -

Brand Reputation: Established brands with a track record of reliability and quality command higher prices and enjoy market trust. -

Government Policies: Subsidies, tax incentives, and regulations supporting electric vehicle adoption and domestic cathode production directly impact market dynamics.

Key Companies in the Cathode Materials Market Include

- Umicore (Belgium)

- 3M (US)

- Mitsubishi Chemical Holdings (Japan)

- POSCO (South Korea)

- Johnson Matthey (UK)

- Hitachi Chemical Co., Ltd. (Japan)

- Kureha Corporation (Japan)

- Sumitomo Corporation (Japan)

- Todakogyo Corp (Japan)

- Mitsui Mining & Smelting (Japan)

- NEI Corporation (US)

- Targray Technology International Inc. (Canada)

Recent News

LG Chem began construction of America’s largest cathodes plant in December 2023 with a capacity of producing sixty thousand tons per year in Tennessee.

Umicore plans to increase CAM PCAM production capacity at its Ontario, Canada site, among other EV battery materials manufacturing facilities needed for lithium-ion type cell power sources mainly driving electric vehicles, were announced in October 2023.

Ascend Element is scheduled to recycle waste generated during the production process at SK Innovation-owned Lithium Battery Giga plants located within Georgia state territory by March 2022.

For example, on April 2023, OCSiAL introduced two types of highly concentrated anode and cathode graphene nanotubes - cost-effective, sustainable alternatives compatible with existing industry infrastructure, including carbon black etc., widely used now while making Li-Ion type batteries or similar energy-storing devices/systems such as supercapacitors/graphene enhanced capacitors etc.

On May first day of May 2023, Cabot Corporation revealed ENTERA aerogel particles designed specifically for usage in lithium-ion batteries with the aim of creating ultra-thin thermal barriers inside electric vehicles. Enterna serves not only as a valuable product for battery manufacturers but also provides thermal management solutions throughout entire EVs themselves thus contributing towards their reliability and safety.