Catheters Size

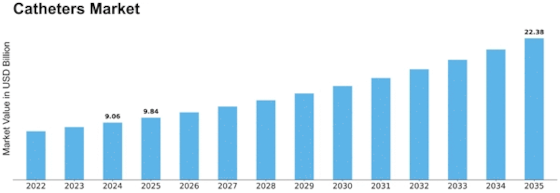

Catheters Market Growth Projections and Opportunities

The catheters sector is affected by rising cardiovascular, urinary, and neurological diseases. Catheters are used to treat chronic disorders, creating need for variety. An aging population impacts the market. Infection prevention requires following these catheter safety precautions. Sterile catheters and strong infection prevention measures for hospital workers are being implemented to reduce catheter-related infections. Design and technical innovations in catheters impact the market. Catheter safety is improved by advanced materials, antimicrobial coatings, and hydrophilic coatings. New technologies increase infection control and patient comfort, expanding the market. Need for less-invasive treatments drives catheter adoption. Catheterization enhances patient outcomes and recovery using less invasive diagnostic and treatment methods. Catheter sales rise as less intrusive procedures become more popular. Elderly patients use urinary catheters. Urinary retention and incontinence might need catheterization with age. Long-term and intermittent catheterization for the elderly fuels market growth. Cardiology diagnostics and interventions need catheters. Demand for cardiovascular catheters such angiography, angioplasty, and electrophysiology catheters has increased due to cardiovascular disease prevalence. Rise of home healthcare affects catheter market. Home catheters are in demand as more medical procedures move to the home. In home healthcare, convenient and user-friendly catheterization options boost market development. Chronic diabetes may cause issues that need insulin and continuous glucose monitoring devices. Diabetic catheters are in demand due to the rising global incidence of diabetes. Infection prevention is important with catheters. Patients are at danger from catheter-associated infections, hence antimicrobial coatings and other characteristics are added. Infection prevention affects product development and market uptake. In the catheter business, regulatory compliance is crucial. Catheter safety and effectiveness depend on tight restrictions, and market access requires regulatory clearances. Quality and safety standards increase provider and patient confidence. The catheters market grows as healthcare infrastructure improves, especially in developing nations. Regions developing healthcare infrastructure see market growth due to improved access and catheterization awareness. The catheter market has been affected by COVID-19. Safe and aseptic catheterization has become more important in healthcare due to infection prevention and control. The epidemic also emphasized the necessity for medical equipment like catheters in healthcare emergencies. Market dynamics are affected by catheter manufacturer rivalry and mergers and acquisitions. Partnerships in research and development create breakthrough catheter solutions and shape market trends.

Leave a Comment