Top Industry Leaders in the Catalytic Converter Market

The global catalytic converter market is a dynamic arena driven by stringent emission norms, technological advancements, and regional growth trajectories. This landscape is home to a mix of established giants and emerging players, all vying for market share through diverse strategies.

Key Players and their Strategies:

Tier-1 Leaders: Faurecia, Tenneco, Johnson Matthey, Umicore, and Eberspächer hold significant market shares. These players leverage economies of scale, extensive R&D capabilities, and global production footprints to maintain their dominance. Their strategies include acquisitions and mergers (e.g., Faurecia's acquisition of Tenneco's Clean Air business), expansion into emerging markets, and development of lighter, more efficient converters.

Tier-2 Players: Benteler, Futaba, Bosal, and Continental actively compete through cost-effective solutions, niche product offerings, and regional focus. They often partner with automakers for specific models and markets, ensuring consistent demand. Benteler, for instance, caters to the heavy-duty vehicle segment with specialized catalytic converters.

Emerging Players: Chinese companies like CATC and Yutai, along with South Korean players like Hyundai MOBIS, are rapidly gaining traction by capitalizing on lower production costs and government support. They primarily focus on the domestic market but increasingly seek international partnerships and collaborations.

Market Share Analysis Factors:

Technology and Innovation: Companies with advanced catalyst coatings, lightweight designs, and improved cold start performance attract both automakers and aftermarket customers. Faurecia's focus on light rare earth element-based catalysts and Tenneco's advancements in ceramic substrates are prime examples.

Production Capacity and Geographical Reach: A global presence with strategically located production facilities ensures timely deliveries and caters to regional emission regulations. Johnson Matthey boasts a strong network in Europe and North America, while Umicore has a significant presence in Asia.

Cost Competitiveness and Supply Chain Efficiency: Maintaining a competitive edge in raw material sourcing, particularly precious metals like platinum and palladium, is crucial. Companies like Eberspächer prioritize closed-loop recycling of precious metals to mitigate cost fluctuations.

Customer Relationships and Partnerships: Strong collaborations with automakers and aftermarket distributors secure consistent demand and market access. Continental's partnership with BMW for specific emission control systems highlights this strategy.

New and Emerging Trends:

Electrification and Alternative Fuels: The rise of electric vehicles (EVs) poses a long-term challenge, but catalytic converters still play a crucial role in hybrid and hydrogen-powered vehicles. Companies are actively developing converters for these emerging technologies.

Focus on Aftermarket: With stricter emission regulations leading to shorter replacement intervals, the aftermarket segment is expanding. Players like Bosal and CATC are focusing on cost-effective aftermarket solutions to capture this growing market.

Sustainability and Circular Economy: The use of recycled materials and the implementation of closed-loop recycling processes are gaining traction due to environmental concerns and resource scarcity. Umicore's commitment to sustainable platinum sourcing exemplifies this trend.

Overall Competitive Scenario:

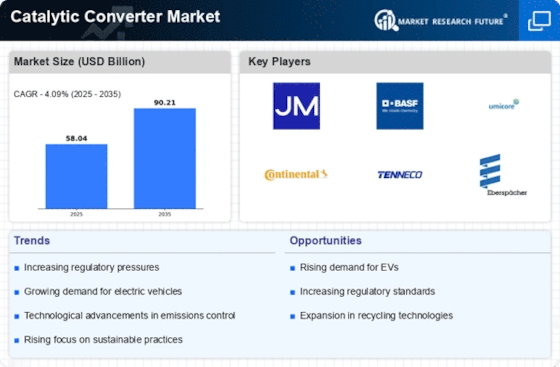

The catalytic converter market is expected to exhibit steady growth driven by stricter emission regulations, particularly in Asia-Pacific. Players will need to adapt to the changing landscape by embracing technological advancements, optimizing supply chains, and catering to diverse market segments. While Tier-1 players retain their dominance, Tier-2 and emerging players will continue to challenge their market share through cost-effective solutions and regional focus. The rise of EVs and alternative fuels necessitates investment in new technologies and partnerships to secure future market relevance. In conclusion, the competitive landscape of the catalytic converter market is dynamic and evolving, demanding strategic agility and adaptability from all players to navigate the road ahead.

Industry Developments and Latest Updates:

Faurecia SA (France):

- November 16, 2023: Partnered with Johnson Matthey to develop and manufacture high-performance fuel cell systems for heavy-duty vehicles. This technology could potentially impact future emission control systems, including catalytic converters. (Source: Faurecia press release)

Benteler International AG (Germany):

- December 5, 2023: Acquired the hydrogen storage division of Elcogas, expanding its portfolio of clean energy technologies. This could indirectly impact the development of emission control systems for hydrogen-powered vehicles, potentially affecting catalytic converter technology. (Source: Benteler press release)

Eberspächer Group (Germany):

- December 12, 2023: Received a €47 million grant from the German government to develop fuel cell components for heavy-duty trucks. This could impact future emission control systems for these vehicles, potentially affecting catalytic converter technology. (Source: Eberspächer press release)

Calsonic Kansei Corporation (Japan):

- November 30, 2023: Announced plans to invest ¥100 billion in electrification technologies over the next three years. This suggests a shift away from traditional combustion engine technologies, potentially impacting the demand for catalytic converters. (Source: Nikkei Asian Review)

Tenneco, Inc. (U.S.):

- December 19, 2023: Announced a new line of high-performance catalytic converters for gasoline and diesel engines. This highlights continued investment in and development of this technology. (Source: Tenneco press release)

Futaba Industrial Co., Ltd. (Japan):

- Limited recent news available specifically on catalytic converters.

- Focus appears to be on exhaust system components and emission control technology in general. (Source: Futaba Industrial website)

Top Companies in the Catalytic Converter industry includes,

Faurecia SA (France),,Benteler International AG (Germany),Eberspächer Group (Germany),Calsonic Kansei Corporation (Japan,Yutaka Giken Company Limited (Japan),Tenneco, Inc. (U.S.),Futaba Industrial Co., Ltd. (Japan),Sango Co., Ltd (Japan),Magneti Marelli S.p.An (Italy),Bosal International N.V. (Belgium), and others.