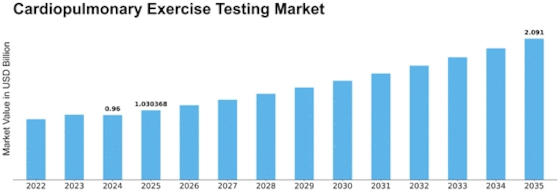

Cardiopulmonary Exercise Testing Size

Cardiopulmonary Exercise Testing Market Growth Projections and Opportunities

The cardiopulmonary exercise testing (CPET) market is influenced by various factors that shape its growth and dynamics. Firstly, the increasing prevalence of cardiovascular and respiratory diseases drives demand for diagnostic tools and procedures such as CPET. As the incidence of conditions such as heart failure, chronic obstructive pulmonary disease (COPD), and pulmonary hypertension continues to rise globally, there's a growing need for accurate and comprehensive assessments of cardiopulmonary function. CPET provides valuable insights into cardiovascular and respiratory performance during exercise, aiding in the diagnosis, prognosis, and management of these conditions.

Moreover, advancements in medical technology play a crucial role in driving market expansion. As CPET systems become more sophisticated and user-friendly, healthcare providers can perform comprehensive cardiopulmonary assessments with greater accuracy and efficiency. Innovations such as portable CPET devices, integrated software platforms, and wireless connectivity enhance the accessibility and usability of CPET systems, allowing for broader adoption in various clinical settings.

Furthermore, regulatory factors influence the CPET market landscape. Regulatory agencies such as the FDA (Food and Drug Administration) in the United States and the European Medicines Agency (EMA) in Europe impose regulations on medical devices and diagnostic tests to ensure safety, efficacy, and quality. Compliance with regulatory standards is essential for manufacturers to obtain market approval and maintain consumer trust in the accuracy and reliability of CPET systems. Changes in regulations or the introduction of new standards may impact market dynamics by affecting product development timelines and market entry strategies.

Additionally, market competition drives innovation and influences pricing strategies within the CPET market. With numerous companies competing in the market, there's a constant push for the development of more advanced CPET systems with enhanced features and functionalities. Manufacturers strive to differentiate their products through factors such as accuracy, user-friendliness, data integration capabilities, and affordability. Price competition also plays a significant role in market dynamics, with manufacturers balancing product quality and pricing to remain competitive while maximizing profitability.

Moreover, demographic trends such as aging populations and increasing healthcare awareness impact market demand for CPET services. As populations age, the prevalence of cardiovascular and respiratory diseases increases, leading to a greater need for diagnostic assessments such as CPET. Older adults are more susceptible to conditions such as heart failure and COPD, which require thorough cardiopulmonary evaluations for proper management and treatment planning. Additionally, increasing healthcare awareness and patient education initiatives contribute to greater recognition of the importance of CPET in cardiovascular and respiratory health assessment.

Furthermore, economic factors such as healthcare expenditure and insurance coverage influence market dynamics and consumer access to CPET services. Countries with higher healthcare spending and better insurance coverage tend to have higher adoption rates of advanced diagnostic tests and procedures, including CPET. Economic downturns or fluctuations in disposable income levels may impact consumer purchasing decisions, leading to shifts in demand for healthcare-related products and services, including CPET.

Additionally, technological advancements in CPET interpretation and data analysis drive market growth and adoption. Integrated software platforms and cloud-based solutions enable healthcare providers to analyze CPET data more efficiently and derive meaningful insights for clinical decision-making. Machine learning algorithms and artificial intelligence (AI) applications offer opportunities for predictive analytics and personalized treatment recommendations based on CPET results, further enhancing the clinical utility of CPET in cardiovascular and respiratory care.

Lastly, public health initiatives and government policies promoting cardiovascular and respiratory health awareness contribute to market expansion. Governments and healthcare organizations worldwide are increasingly investing in preventive healthcare programs, disease screening initiatives, and patient education campaigns to raise awareness about cardiovascular and respiratory diseases and their risk factors. CPET plays a crucial role in these initiatives by providing objective assessments of cardiopulmonary function and helping identify individuals at risk for cardiovascular and respiratory conditions.

Leave a Comment