Market Trends

Key Emerging Trends in the Carbon Thermoplastic Composites Market

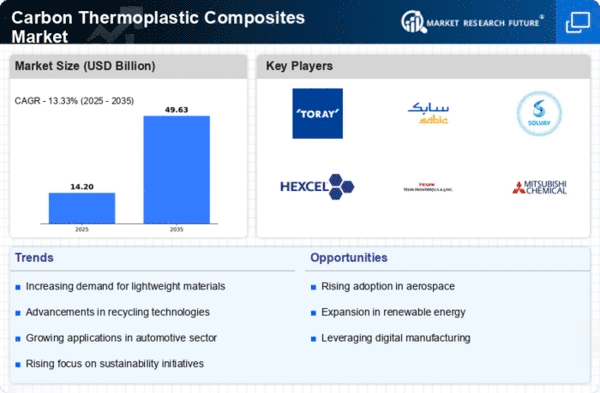

The Carbon Thermoplastic Composites Market has been witnessing notable trends, reflecting the growing demand for lightweight and high-performance materials across various industries. One of the key drivers behind the market's upward trajectory is the increasing emphasis on fuel efficiency and sustainability. As industries strive to meet stringent environmental regulations, there has been a notable shift towards materials that offer a favorable strength-to-weight ratio, and carbon thermoplastic composites perfectly fit the bill.

The automotive sector stands out as a major contributor to the market trends. With a constant drive towards manufacturing lightweight vehicles for enhanced fuel efficiency, automakers are increasingly turning to carbon thermoplastic composites. These materials offer a compelling alternative to traditional metals, providing a perfect balance between strength and weight reduction. As electric vehicles gain prominence, the demand for lightweight components becomes even more critical to extend the range and improve overall performance.

In addition to automotive applications, the aerospace industry is a significant player in driving market trends for carbon thermoplastic composites. Aircraft manufacturers are exploring ways to reduce weight without compromising structural integrity, and carbon thermoplastics emerge as a viable solution. The materials' excellent strength and durability, coupled with their ability to withstand extreme conditions, make them ideal for various aerospace components, from interior elements to structural components.

Another noteworthy trend in the market is the increasing adoption of carbon thermoplastic composites in the sporting goods industry. Whether it's bicycles, golf clubs, or snowboards, manufacturers are incorporating these advanced materials to enhance performance characteristics. Athletes benefit from the improved strength and flexibility of products made with carbon thermoplastics, leading to a surge in demand for these materials in the sports equipment sector.

Furthermore, the renewable energy sector is contributing to the market trends of carbon thermoplastic composites. As the world shifts towards cleaner and sustainable energy sources, there is a growing need for materials that can withstand harsh environmental conditions in renewable energy infrastructure. Carbon thermoplastic composites offer excellent resistance to corrosion and fatigue, making them suitable for applications in wind turbine blades, solar panels, and other renewable energy components.

The market trends also indicate a focus on research and development activities aimed at expanding the application scope of carbon thermoplastic composites. Innovations in manufacturing processes and the development of new formulations are driving advancements in the properties of these materials, opening up possibilities for their use in diverse industries. As research efforts continue to address cost challenges and improve production efficiency, the market is likely to witness further growth in the coming years.

Leave a Comment