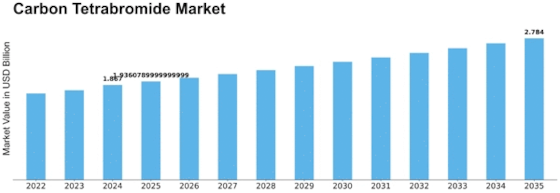

Carbon Tetrabromide Size

Carbon Tetrabromide Market Growth Projections and Opportunities

The Carbon Tetrabromide market is subject to various market factors that significantly impact its growth and dynamics. Understanding these factors is crucial for industry participants, investors, and stakeholders looking to navigate this particular segment of the chemical industry. Here are key market factors influencing the Carbon Tetrabromide market, presented in a clear pointer format: Chemical Industry Dynamics: The demand for Carbon Tetrabromide is intricately tied to the broader dynamics of the chemical industry. Factors such as raw material availability, technological advancements, and regulatory changes within the chemical sector can directly influence the production and pricing of Carbon Tetrabromide. Applications in Flame Retardants: A major driver for the Carbon Tetrabromide market is its use in flame retardant applications. As industries across sectors prioritize fire safety, Carbon Tetrabromide is in demand for formulating flame retardants, especially in industries like textiles, electronics, and construction. Environmental Regulations: Stringent environmental regulations and concerns about the impact of certain brominated compounds on the environment play a significant role in shaping the Carbon Tetrabromide market. Changes in regulations related to the use of brominated compounds can impact the demand for Carbon Tetrabromide and drive the development of alternative solutions. Technological Advancements: Advances in production technologies and synthesis methods influence the efficiency and cost-effectiveness of Carbon Tetrabromide manufacturing. Companies investing in research and development to enhance production processes and reduce environmental impact gain a competitive edge in the market. Global Fire Safety Standards: The adherence to global fire safety standards, particularly in sectors like electronics and automotive, directly impacts the demand for flame retardants like Carbon Tetrabromide. Companies providing products that meet or exceed these standards are well-positioned in the market. Market for Polymeric Materials: The Carbon Tetrabromide market is closely linked to the demand for polymeric materials, as brominated flame retardants are widely used in polymers to improve fire resistance. Therefore, trends in the polymer industry, such as the demand for specific types of plastics, affect the consumption of Carbon Tetrabromide. Consumer Electronics Industry: The growth of the consumer electronics industry is a significant factor in the Carbon Tetrabromide market. With the increasing use of electronic devices worldwide, there is a parallel demand for flame retardants to enhance the fire safety of electronic components and devices. Shift towards Halogen-Free Alternatives: The market for brominated flame retardants, including Carbon Tetrabromide, faces challenges due to the growing preference for halogen-free alternatives. Concerns about the environmental and health impacts of brominated compounds have led to a shift in consumer preferences and industry regulations. Supply Chain Dynamics: The Carbon Tetrabromide market is sensitive to changes in the supply chain, including the availability and pricing of raw materials. Fluctuations in the supply of key ingredients can impact the overall production costs and, consequently, the pricing of Carbon Tetrabromide. Geopolitical Factors: Political and economic factors, both globally and regionally, can influence the Carbon Tetrabromide market. Trade policies, geopolitical tensions, and economic conditions in key manufacturing and consuming regions can impact the supply and demand dynamics of Carbon Tetrabromide.

Leave a Comment