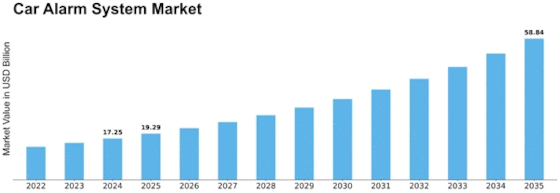

Car Alarm System Size

Car Alarm System Market Growth Projections and Opportunities

A number of factors influence the car alarm system market, all contributing to what shapes this industry in response to ever-changing needs among vehicle owners and manufacturers as well as a greater automotive environment. Vehicle security remains a major contributor to the growth of the car alarm system market. As the cases of car theft and vandalism increase, consumers and manufacturers are focusing on the high-performance security elements. Car alarm systems are preventative measures, helping to protect vehicles and aiding in general safety. The market of car alarm system is also influenced by legislatures and regulatory standards. Regulatory bodies around the world are implementing policies aimed at enhancing vehicle safety, while some regions require certain security features such as car alarm systems in new vehicles. Such regulatory initiatives have an impact on both OEMs and aftermarket suppliers, creating the need for standardized as well as certified alarm kits that would fulfill compliance demands. Technological developments in the automotive industry lead to better alarm systems. Smart technologies integrated with modern day car alarms offer remote tracking, ability to access them via smartphones and GPS vehicle location system. The implementation of such functionality not only helps improve security but also follows the trend in connected automotive vehicles and IoT. Car alarm system market is influenced by consumer awareness and preferences. The knowledge is being more aware of the security options; car owners demand advanced alarm systems with customization, ease in usage and compatibility. Responding to these consumer needs manufacturers introduce user-friendly interfaces, handhelds with intuitive controls along the lines of two-way communication or even smartphone apps. The development of EVs and hybrid vehicles is also an important driver in the dynamics of car alarm system market. The automotive sector is moving towards a transition to sustainable mobility, through which manufacturers have developed alarm systems tailor-made for electric and hybrid cars. To compensate for the unique needs of such automobiles, an incorporation of alarm system alongside EV-specific elements like battery safety and charging port assurance emerges as necessary. The car alarm market is influenced by the economic factors such as purchasing power, disposable income and overall economy. Price of alarm systems, threat to insurance premiums makes consumer opt for such security features.

Leave a Comment