Innovative Flavor Profiles

Innovation in flavor profiles is significantly influencing the functional beverages market. Canadian consumers are increasingly seeking unique and exciting flavors that not only provide health benefits but also enhance the overall drinking experience. This trend has led to the introduction of exotic ingredients and flavor combinations, appealing to a broader audience. For instance, beverages infused with adaptogens, superfoods, and botanicals are gaining traction. Market data indicates that the segment of functional beverages with innovative flavors has seen a growth rate of 15% annually. The functional beverages market is thus adapting to these preferences, encouraging manufacturers to invest in research and development to create products that stand out in a competitive landscape.

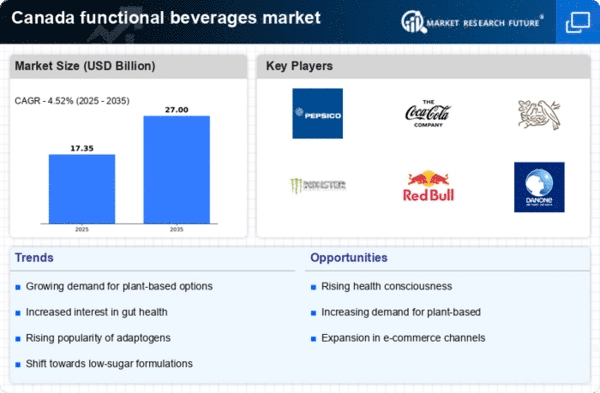

Rising Health Consciousness

The increasing awareness of health and wellness among Canadian consumers is a primary driver for the functional beverages market. As individuals become more informed about the benefits of nutrition and hydration, they are gravitating towards beverages that offer functional benefits, such as enhanced immunity, improved digestion, and increased energy. According to recent data, approximately 60% of Canadians actively seek out functional beverages that align with their health goals. This trend is likely to continue, as consumers prioritize products that contribute positively to their overall well-being. The functional beverages market is thus experiencing a surge in demand for products that cater to these health-conscious consumers, leading to innovative formulations and marketing strategies that emphasize health benefits.

Increased Focus on Mental Health

The growing emphasis on mental health and well-being is emerging as a significant driver for the functional beverages market. Canadians are increasingly recognizing the importance of mental wellness, leading to a demand for beverages that support cognitive function and emotional balance. Products containing ingredients such as adaptogens, nootropics, and herbal extracts are gaining popularity. Recent surveys indicate that nearly 30% of consumers are actively seeking functional beverages that promote mental clarity and stress relief. This trend is prompting the functional beverages market to innovate and expand their product lines to include options that cater to mental health needs, thereby tapping into a vital segment of the health-conscious consumer base.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of Canadians is driving the demand for convenient, on-the-go functional beverages. As consumers seek products that fit seamlessly into their busy schedules, ready-to-drink options are becoming increasingly popular. This shift is reflected in market data, which shows that ready-to-drink functional beverages account for over 40% of total sales in the functional beverages market. The industry is responding by offering portable packaging and single-serve options that cater to the needs of consumers who prioritize convenience without compromising on health benefits. This trend is likely to shape product development strategies within the functional beverages market, as brands strive to meet the evolving demands of their target audience.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a crucial consideration for Canadian consumers, influencing their purchasing decisions in the functional beverages market. There is a growing demand for products that are not only beneficial for health but also environmentally friendly. Consumers are increasingly favoring brands that utilize sustainable sourcing practices and eco-friendly packaging. Market Research Future suggests that approximately 50% of Canadians are willing to pay a premium for beverages that align with their environmental values. This shift is prompting the functional beverages market to adopt more sustainable practices, from ingredient sourcing to packaging solutions, thereby appealing to a conscientious consumer base that prioritizes both health and environmental impact.