Calcium Oxide Size

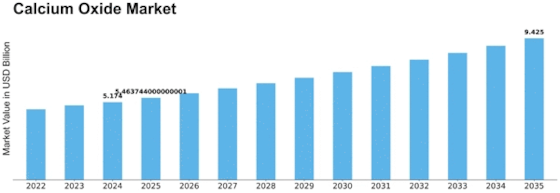

Calcium Oxide Market Growth Projections and Opportunities

The calcium oxide market is shaped by various factors that influence its growth and dynamics. One pivotal factor is the widespread use of calcium oxide, also known as quicklime, across diverse industries such as construction, metallurgy, chemical manufacturing, environmental remediation, and agriculture. Calcium oxide serves as a versatile chemical compound with applications ranging from soil stabilization and pH regulation to steel production and water treatment. The growing demand for infrastructure development, industrial processes, and environmental protection drives the need for calcium oxide, fostering market expansion.

Technological advancements and innovations in calcium oxide production processes play a significant role in market development. Manufacturers continually invest in research and development to enhance production efficiency, product quality, and environmental sustainability. Innovations in kiln design, raw material utilization, and emission control technologies enable the production of high-purity calcium oxide with reduced environmental impact. Additionally, advancements in hydration processes and particle size control improve the performance and versatility of calcium oxide products, catering to diverse end-user requirements.

The availability of abundant raw materials for calcium oxide production is another crucial market factor. Limestone, the primary raw material for calcium oxide manufacturing, is widely distributed globally, ensuring a stable supply chain for producers. This availability minimizes dependency on imports and contributes to cost-effectiveness in production. Furthermore, advancements in mining techniques, quarrying practices, and logistics optimize the sourcing and transportation of raw materials, enhancing the competitiveness of the calcium oxide market.

Regulatory compliance and adherence to industry standards significantly influence the calcium oxide market. Environmental regulations regarding emissions, waste disposal, and workplace safety impose strict requirements on calcium oxide producers. Compliance with these regulations is essential for maintaining operational licenses and market access. Moreover, adherence to quality standards and certifications ensures product reliability, safety, and performance, enhancing market competitiveness and customer trust in calcium oxide products.

Market competition plays a vital role in shaping the calcium oxide market landscape. Key players in the industry engage in competitive strategies such as product differentiation, pricing tactics, and geographical expansion to gain a competitive edge and capture market share. Established calcium oxide manufacturers leverage their technical expertise, production capabilities, and distribution networks to maintain leadership positions. Conversely, emerging players focus on innovation, customer service, and niche markets to establish their presence and compete effectively.

Global economic factors significantly impact the calcium oxide market, including economic growth rates, industrial output, and infrastructure development. Economic downturns can lead to reduced demand for calcium oxide, particularly in construction and manufacturing sectors, affecting market growth. Conversely, economic recovery, increased construction activity, and infrastructure spending stimulate demand for calcium oxide, driving market expansion.

Consumer preferences and industry trends also influence the calcium oxide market dynamics. There is a growing emphasis on sustainability, environmental stewardship, and resource conservation, driving demand for eco-friendly materials and processes. Calcium oxide manufacturers respond to these trends by adopting sustainable production practices, reducing carbon emissions, and promoting recycling initiatives. Additionally, advancements in application technologies and product formulations cater to evolving customer needs and preferences, driving innovation and market growth.

Leave a Comment