Butadiene Size

Butadiene Market Growth Projections and Opportunities

The Butadiene market is influenced by a lot of factors that combine to determine its dynamics. One of the main market factors is supply and demand balance. Butadiene raw material availability involving the production of n-butane, butanes for it has direct impact on supply. Additionally, demand for butadiene, which is the major feedstock for synthetic rubber as well as some other chemical products, is interrelated with car-making and construction industries. Thus, there are variations in consumption of butadiene with changes in such sectors.

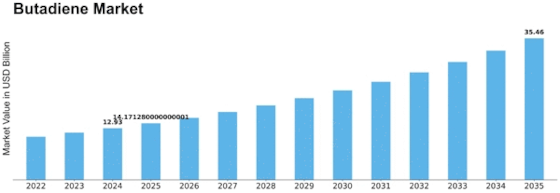

Butadiene Market Size was valued at USD 10.8 Billion in 2022. The compound annual growth rate (CAGR) will be 9.60% during the forecast period (2023-2032), to attain a market value exceeding USD 24.64 billion by 2032.

Regulatory factors also play an important role in determining the Butadiene market position. Stringent environmental regulations and standards on production and use of chemicals affect manufacture process of butadiene itself. Environmental concerns have led to increased focus on sustainable and eco-friendly production methods influencing the market dynamics thereof. Further still trade policies like government trade policies coupled with tariffs could impact geopolitical events hence global chains of supplies affecting the Butadiene markets.

Technological advancements and innovations are similarly significant contributors to market factors affecting Butadiene industry. Continuous researches and development efforts towards different techniques for producing butadienes catalysts used during this process purification can result into better effectiveness plus reduced cost implications due to minimized wastes. On top of enhancing demand for butadienes such innovations could also create many downstream applications including high-performance synthetic rubbers.

The price of crude oil plays a critical role in relation to Butadiene as it has been primarily derived from hydrocarbons that are obtained from crude oil refining processes principally those involved in petrochemicals industry processing unit operations because; fluctuations in oil prices directly affect the cost of producing butadiene by manufacturers. Moreover, availability of alternative sources used to make Butadiene (bio-based methods) can shape the market by offering more environmentally friendly and competitive options.

Market competition is another vital factor while key industry players are also necessary for shaping the Butadiene market. The number of producers, their market shares as well as production capacities influence pricing approaches and general market operations in this sector. Furthermore, mergers and acquisitions between different entities making up a value chain on the one hand and strategic alliances on the other may significantly alter its overall competitiveness.

Consumer preferences and trends are essential market factors influencing the Butadiene market. While bio-based or recycled butadienes respond to increased environmental awareness among customers, they aim at developing sustainable products. On the other hand, some specific brands of synthetic rubbers manufactured or areas where they are applied influence demand patterns of butadienes.

Leave a Comment