Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the Business Intelligence Market. Organizations are increasingly adopting cloud technologies to facilitate scalable and flexible data management solutions. This transition allows businesses to access real-time data analytics from anywhere, enhancing collaboration and decision-making processes. Recent data indicates that the cloud segment of the business intelligence market is expected to grow at a rate of 15% annually, driven by the increasing need for cost-effective and efficient data storage solutions. Furthermore, the ability to integrate cloud-based business intelligence tools with existing enterprise systems is likely to enhance operational efficiency, thereby contributing to the overall growth of the Business Intelligence Market.

Regulatory Compliance and Data Governance

The emphasis on regulatory compliance and data governance is shaping the Business Intelligence Market. Organizations are increasingly required to adhere to stringent regulations regarding data privacy and security. This has led to a heightened focus on implementing robust data governance frameworks that ensure compliance while maximizing the value of data assets. The market for data governance solutions is expected to grow at a rate of approximately 12% annually, driven by the need for organizations to mitigate risks associated with data breaches and non-compliance. As businesses prioritize data integrity and security, the demand for business intelligence solutions that incorporate governance features is likely to rise, further propelling the growth of the Business Intelligence Market.

Growing Importance of Predictive Analytics

Predictive analytics is emerging as a critical component within the Business Intelligence Market. Organizations are increasingly utilizing predictive models to forecast trends, customer behavior, and market dynamics. This capability allows businesses to proactively address challenges and seize opportunities, thereby enhancing their competitive edge. The market for predictive analytics is projected to grow significantly, with estimates suggesting a potential increase to over 20 billion USD by 2025. This growth is attributed to the rising demand for advanced analytical capabilities that can transform raw data into actionable insights. As companies continue to invest in predictive analytics, the Business Intelligence Market is likely to witness substantial advancements in technology and methodologies.

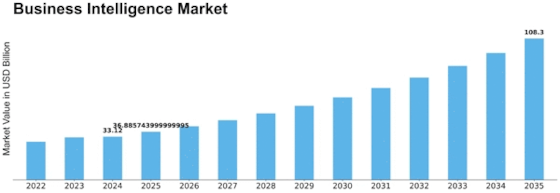

Increased Demand for Data-Driven Decision Making

The Business Intelligence Market is experiencing a notable surge in demand for data-driven decision making. Organizations across various sectors are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and strategic planning. According to recent estimates, the market for business intelligence solutions is projected to reach approximately 30 billion USD by 2026, reflecting a compound annual growth rate of around 10%. This trend is driven by the need for real-time insights and the ability to make informed decisions based on comprehensive data analysis. As businesses strive to remain competitive, the integration of advanced analytics tools into their operations is becoming essential, thereby propelling the growth of the Business Intelligence Market.

Emergence of Self-Service Business Intelligence Tools

The emergence of self-service business intelligence tools is transforming the landscape of the Business Intelligence Market. These tools empower non-technical users to access and analyze data independently, thereby democratizing data analytics within organizations. The increasing demand for user-friendly interfaces and intuitive analytics solutions is driving the adoption of self-service tools. Recent market analysis suggests that the self-service segment is expected to grow at a compound annual growth rate of around 18% over the next few years. This trend indicates a shift towards enabling business users to derive insights without relying heavily on IT departments, thereby enhancing agility and responsiveness in decision-making processes. As self-service capabilities expand, the Business Intelligence Market is likely to evolve, catering to a broader audience.

Leave a Comment