Aging Population

The aging population is a primary driver of the Burial Insurance Market. As life expectancy increases, the number of individuals requiring burial insurance is likely to rise. In many regions, the demographic shift towards an older population suggests a growing need for financial products that address end-of-life expenses. According to recent statistics, individuals aged 65 and older are projected to account for a significant portion of the population in the coming years. This demographic trend indicates that more people will seek burial insurance to alleviate the financial burden on their families. Consequently, the Burial Insurance Market is expected to expand as more consumers recognize the necessity of planning for funeral costs and related expenses.

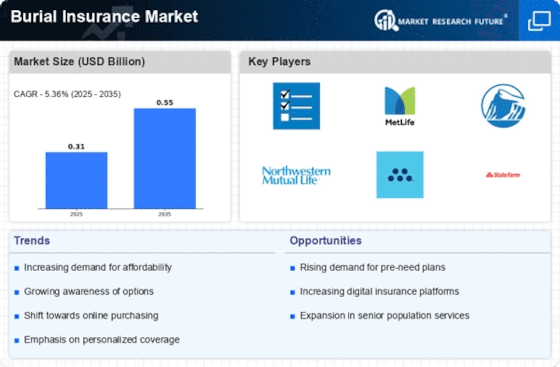

Rising Funeral Costs

Rising funeral costs serve as a crucial driver for the Burial Insurance Market. The average cost of a funeral has seen a steady increase, with estimates suggesting that it may reach upwards of 10,000 to 15,000 in various regions. This escalation in expenses compels individuals to consider burial insurance as a viable solution to cover these costs. As families face the financial strain of arranging funerals, the demand for burial insurance products is likely to grow. The Burial Insurance Market is responding to this trend by offering policies that cater to different financial needs, ensuring that consumers can find suitable options to protect their loved ones from unexpected expenses.

Technological Integration

Technological integration is transforming the Burial Insurance Market by enhancing accessibility and efficiency. The rise of digital platforms allows consumers to research, compare, and purchase burial insurance policies online, streamlining the decision-making process. This shift towards technology-driven solutions is particularly appealing to younger generations who prefer online transactions. Additionally, insurers are utilizing data analytics to better understand consumer preferences and tailor their offerings accordingly. As technology continues to evolve, the Burial Insurance Market is expected to benefit from increased engagement and a broader customer base, as more individuals turn to digital solutions for their insurance needs.

Increased Financial Literacy

Increased financial literacy among consumers is positively influencing the Burial Insurance Market. As individuals become more educated about financial planning, they are more likely to consider burial insurance as part of their overall strategy. This trend is evident in various surveys indicating that a growing number of people understand the importance of preparing for end-of-life expenses. Enhanced awareness of financial products, including burial insurance, suggests that consumers are actively seeking ways to secure their families' financial futures. The Burial Insurance Market is adapting to this shift by providing clearer information and more accessible options, thereby encouraging more individuals to invest in burial insurance.

Customization of Insurance Products

The customization of insurance products is emerging as a significant driver in the Burial Insurance Market. Consumers increasingly seek personalized solutions that align with their specific needs and preferences. Insurers are responding by offering tailored burial insurance policies that allow individuals to select coverage amounts, payment plans, and additional benefits. This trend towards personalization not only enhances customer satisfaction but also encourages more people to consider burial insurance as a practical option. The Burial Insurance Market is likely to see growth as more consumers recognize the value of customized products that cater to their unique circumstances and financial situations.