Bulletproof Glass Size

Bulletproof Glass Market Growth Projections and Opportunities

The Bulletproof Glass Market has several market influences that contribute to its growth and dynamics. One of the main drivers is increased security concerns in different sectors. An upswing in vandalism, thefts, and terrorist acts has seen an increase in demand for bulletproof glasses in areas such as banking, retail and government facilities. The market demands advanced security solutions.

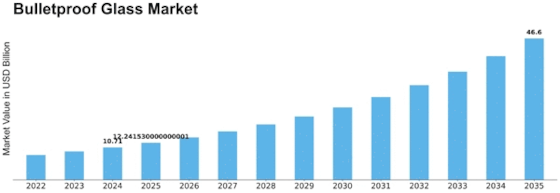

Bulletproof Glass Market Size valued at USD 8.2 billion in 2022 is expected to grow from USD 9.37 Billion in 2023 to USD 27.30 billion by 2032 at a Compound Annual Growth Rate (CAGR) of around 14.30%.

There are also technological advancements shaping the Bulletproof Glass Market. As materials science research advances, bulletproof glass can be manufactured which stops bullets better but is lighter and more transparent too. Thereby, bullet proof glass finds wider acceptance into architectural applications like residential or commercial buildings where aesthetics and visibility are equally important.

Bullet proof Glass market is dependent on economic factors as well; this includes economic stability and growth rates which determine the will of business organizations and governments to invest in matters bordering on safety measures. Bullet proof Glasses demand tend to rise when an economy is doing well leading to increased security measures during construction projects infrastructure development. Because of this there may be reduced spending on security measures due to economic recessions thereby affecting the market negatively.

Global geopolitical factors also drive sales for bulletproof glass. Unstable political conditions coupled with high crime rates often necessitate higher security levels including usage of shatter proof glasses. Apart from conflicts within certain regions of the world that have necessitated use of this type kind of window panes especially by army personnel’s

Leave a Comment