Bubble Alumina Size

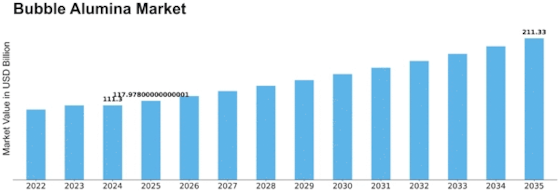

Bubble Alumina Market Growth Projections and Opportunities

The bubble alumina market is influenced by several key factors that shape its production, demand, and pricing dynamics. One significant driver of this market is the growing demand for high-performance refractory materials across various industries. Bubble alumina, characterized by its lightweight, high thermal insulation properties, and resistance to thermal shock, finds extensive use in sectors such as steel, ceramics, chemicals, and aerospace. It is used in applications such as insulation, lining, furnace refractories, and catalyst supports. The increasing demand for durable and heat-resistant materials in extreme temperature environments drives the adoption of bubble alumina in diverse industrial applications, thereby fueling market growth.

Another significant factor influencing the bubble alumina market is technological advancements and innovations in manufacturing processes. Manufacturers are continually innovating to improve production efficiency, product purity, and particle size distribution. Advanced manufacturing techniques such as foaming, sintering, and bubble stabilization enable the production of bubble alumina with controlled porosity, uniform microstructure, and tailored properties. Additionally, advancements in raw material selection, calcination processes, and post-treatment methods lead to the development of bubble alumina products with enhanced thermal stability, mechanical strength, and chemical resistance. These technological advancements not only enhance product quality and performance but also drive down production costs, thereby stimulating market growth.

Furthermore, market demand for bubble alumina is closely tied to the performance and growth of end-user industries. In the steel sector, bubble alumina is used in applications such as ladle lining, tundish insulation, and refractory bricks for steelmaking furnaces. The increasing demand for high-quality steel products, coupled with stringent quality and productivity requirements, drives the adoption of bubble alumina in the steel industry. Similarly, in the ceramics sector, bubble alumina finds applications in kiln furniture, thermal barrier coatings, and crucibles. The growing demand for advanced ceramics in electronics, automotive, and aerospace applications fuels the growth of the bubble alumina market in the ceramics industry.

Market competition is another significant factor influencing the bubble alumina market dynamics. The presence of numerous manufacturers and suppliers competing for market share can lead to price competition and product differentiation strategies. Factors such as product quality, reliability, technical support, and delivery lead times play crucial roles in gaining a competitive edge within the market. Strategic alliances, partnerships, and mergers & acquisitions are common strategies adopted by market players to strengthen their market position, expand their product portfolios, and enhance their geographic reach.

Furthermore, regulatory standards and industry certifications play a crucial role in shaping the bubble alumina market. Regulatory requirements related to product safety, performance, and environmental impact drive the adoption of quality standards such as ASTM, ISO, and EN in the manufacturing and use of bubble alumina products. Compliance with these standards ensures product reliability, durability, and suitability for various applications, thereby fostering customer trust and confidence in bubble alumina products. Additionally, adherence to regulatory standards enables manufacturers to access global markets and compete effectively on a global scale.

Moreover, global economic conditions and trade policies impact the bubble alumina market on a broader scale. Economic factors such as GDP growth, industrial production, and consumer spending influence the demand for bubble alumina products across different regions. Trade policies, tariffs, and geopolitical tensions can disrupt supply chains and trade flows, thereby affecting market dynamics and prices. Additionally, currency exchange rates and inflation rates can impact the competitiveness of bubble alumina manufacturers operating in global markets.

Leave a Comment