Brick Carton Packaging Size

Brick Carton Packaging Market Growth Projections and Opportunities

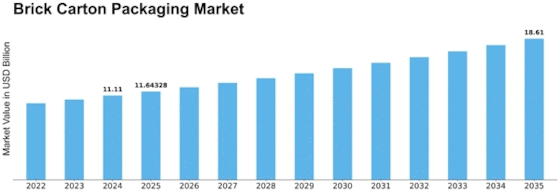

The brick-carton packaging market is a function of numerous market actors, which gives it its dynamics. The growing demand for alternative packaging solutions is one of the prime drivers behind this market's growth. Since brick-carton packaging is made from renewable resources and is recyclable, it aligns with these sustainability goals. Brick-carton Packaging Market size was valued at USD 10.1 Billion in 2022. The Brick-carton Packaging Industry will grow from USD 10.6 Billion in 2023 to USD 15.4 Billion by 2032 at a CAGR of 4.80%. Another key aspect influencing the expansion of the brick-carton packaging industry has been the increasing trend towards convenience-oriented lifestyles where products are required to be easily consumed or used on the go. Similarly, the competitive landscape also plays an integral role in shaping the brick-and-mortar packaging industry. Enterprises making packets must always be innovative in order to be ahead of others in their markets. Technological advancements have led to improved printing opportunities, resulting in vibrant and eye-catching packet designs that appeal to consumers. Market factors are not only influenced by consumer preferences but are also responsive to regulatory changes. This has seen countries across the globe enact laws that restrict harmful substances on packages, hence raising demand for eco-friendly alternatives like brick cartons due to environmental concerns. Consequently, many companies have proactively adopted sustainable package practices so as to conform their businesses with regulations and maintain good reputations. Furthermore, the global economic landscape has a significant impact on the brick-carton packaging market. Economic fluctuations, along with currency exchange rates and inflation, can affect production costs and, consequently pricing of brick-carton packaging materials/services. Such economic factors need adjustment by producers so that they remain competitive and still make their products affordable within the marketplace. The demographics plus choices made by customers contribute to the market dynamics when it comes to brick-carton packaging. For example, as consumers become more health conscious, there is an increasing demand for nutritional and organic products. Packaging that emphasizes the health benefits and quality of the product, such as the transparency and freshness preservation provided by brick cartons, is gaining prominence in the market.

Leave a Comment