Rising Urbanization Rates

The rapid urbanization in Brazil is a pivotal driver for the proptech market. As more individuals migrate to urban areas, the demand for housing and commercial spaces intensifies. This trend is reflected in the increasing population density in major cities like Sao Paulo and Rio de Janeiro, which has led to a surge in real estate development projects. The Brazilian Institute of Geography and Statistics indicates that urban areas are expected to house over 85% of the population by 2030. Consequently, proptech solutions that streamline property management and enhance user experience are becoming essential. The proptech market is likely to benefit from this urban influx, as innovative technologies can address the challenges of space optimization and efficient resource allocation.

Data-Driven Decision Making

The emphasis on data-driven decision making is emerging as a crucial driver for the proptech market in Brazil. Real estate professionals are increasingly utilizing data analytics to inform their strategies, from pricing to marketing. The availability of big data and advanced analytics tools allows stakeholders to gain insights into market trends, consumer behavior, and property valuations. This trend is particularly relevant in a market where informed decisions can lead to competitive advantages. As the proptech market continues to evolve, companies that harness data effectively are likely to outperform their peers. The integration of data analytics into real estate operations is expected to enhance efficiency and profitability, thereby driving further growth in the sector.

Evolving Consumer Preferences

Consumer preferences in Brazil are shifting towards more tech-savvy solutions in the real estate sector, which is a significant driver for the proptech market. Today's consumers are increasingly seeking convenience, transparency, and efficiency in property transactions. The rise of digital platforms for property listings and virtual tours reflects this trend. According to recent surveys, over 60% of Brazilian homebuyers prefer using online platforms for their property searches. This shift in behavior indicates a growing acceptance of technology in real estate dealings. As a result, proptech companies that offer user-friendly interfaces and innovative solutions are likely to thrive in this evolving landscape, catering to the demands of a tech-oriented consumer base.

Investment in Smart Technologies

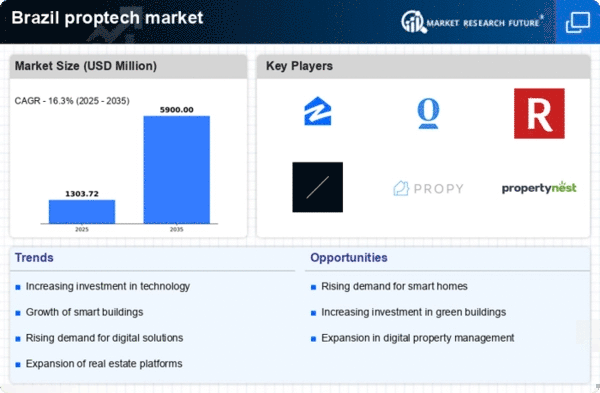

The investment in smart technologies is transforming the landscape of the proptech market in Brazil. With the increasing adoption of IoT devices and smart home solutions, property developers are integrating these technologies into new constructions. This trend is driven by consumer demand for enhanced living experiences and energy efficiency. Reports suggest that the smart home market in Brazil is projected to grow at a CAGR of 25% over the next five years. As more properties incorporate smart features, the proptech market is likely to expand, offering solutions that facilitate the management and automation of these technologies. This integration not only enhances property value but also attracts tech-savvy buyers.

Government Initiatives and Support

Government policies in Brazil are increasingly favoring the adoption of technology in the real estate sector, thereby propelling the proptech market. Initiatives aimed at digital transformation and smart city development are gaining traction. For instance, the Brazilian government has launched programs to promote innovation in urban planning and infrastructure. These initiatives often include financial incentives for startups and established companies that integrate technology into their operations. The National Development Bank of Brazil has allocated substantial funds to support tech-driven real estate projects. This supportive environment is likely to foster growth in the proptech market, as companies leverage government resources to enhance their technological capabilities.