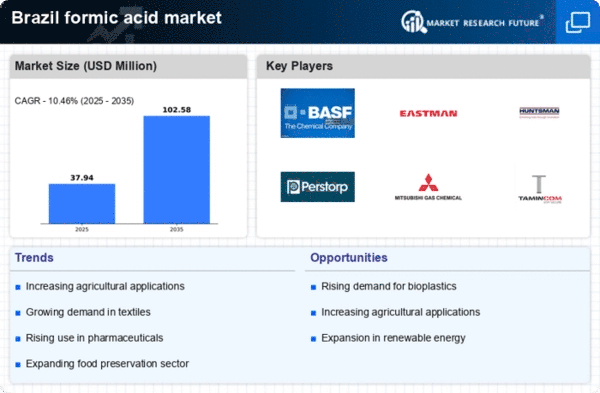

The formic acid market in Brazil exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by increasing demand across various sectors such as agriculture, textiles, and pharmaceuticals. Key growth drivers include the rising need for eco-friendly chemicals and the expansion of agricultural applications. Major companies like BASF SE (Germany), Eastman Chemical Company (US), and Huntsman Corporation (US) are strategically positioned to leverage their extensive product portfolios and innovation capabilities. Their operational focus on sustainability and digital transformation appears to be shaping the competitive environment, fostering a shift towards more environmentally friendly production methods and enhanced operational efficiencies.In terms of business tactics, companies are increasingly localizing manufacturing to reduce logistics costs and improve supply chain resilience. The market structure is moderately fragmented, with a mix of large multinational corporations and smaller regional players. This fragmentation allows for a diverse range of products and services, although the collective influence of key players like BASF SE (Germany) and Eastman Chemical Company (US) tends to dominate market trends and pricing strategies.

In October BASF SE (Germany) announced the launch of a new line of sustainable formic acid products aimed at reducing carbon emissions during production. This strategic move not only aligns with global sustainability goals but also positions BASF as a leader in eco-friendly chemical solutions, potentially enhancing its market share in Brazil. The emphasis on sustainability is likely to resonate well with environmentally conscious consumers and businesses alike.

In September Eastman Chemical Company (US) expanded its production capacity for formic acid in Brazil, investing approximately $50 million in state-of-the-art technology. This expansion is significant as it not only increases supply to meet growing demand but also enhances Eastman's ability to offer customized solutions to local customers. Such investments indicate a commitment to long-term growth in the region and a strategic response to competitive pressures.

In August Huntsman Corporation (US) entered into a strategic partnership with a local Brazilian firm to enhance its distribution network for formic acid. This collaboration is expected to streamline operations and improve market penetration, allowing Huntsman to better serve its customers while optimizing logistics. The partnership reflects a broader trend of companies seeking local alliances to strengthen their market positions and adapt to regional dynamics.

As of November current competitive trends in the formic acid market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to navigate the complexities of the market. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards innovation, technological advancements, and supply chain reliability, underscoring the importance of sustainable practices in shaping future market dynamics.