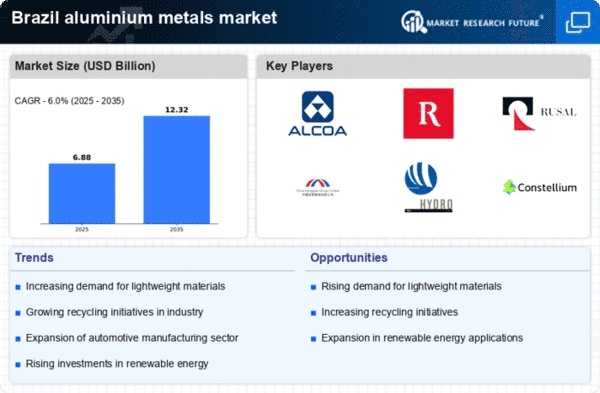

The aluminium metals market in Brazil is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Alcoa Corporation (US), Rio Tinto (GB), and Norsk Hydro ASA (NO) are actively pursuing strategies that emphasize technological advancements and environmental responsibility. Alcoa Corporation (US) has focused on enhancing its production efficiency through the adoption of advanced manufacturing technologies, while Rio Tinto (GB) has been investing in sustainable mining practices to reduce its carbon footprint. These strategies not only bolster their operational capabilities but also contribute to a more competitive environment where sustainability is becoming a critical differentiator.In terms of business tactics, companies are increasingly localizing manufacturing to better serve regional markets and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over pricing and production standards. This fragmentation allows for a diverse range of offerings, yet the collective actions of major companies like Constellium SE (NL) and Novelis Inc. (US) are pivotal in shaping market dynamics. Their focus on recycling and sustainable practices is indicative of a broader trend towards circular economy principles within the industry.

In October Alcoa Corporation (US) announced a partnership with a Brazilian renewable energy firm to power its smelting operations with 100% renewable energy. This strategic move is likely to enhance Alcoa's sustainability credentials while reducing operational costs, positioning the company favorably in a market that increasingly values environmental stewardship. The partnership underscores the importance of aligning operational strategies with sustainability goals, which is becoming a key competitive factor.

In September Rio Tinto (GB) launched a new initiative aimed at increasing the use of recycled aluminium in its products. This initiative not only addresses the growing demand for sustainable materials but also aligns with global trends towards reducing waste and promoting recycling. By enhancing its product offerings with recycled content, Rio Tinto is likely to attract environmentally conscious consumers and strengthen its market position.

In August Norsk Hydro ASA (NO) expanded its operations in Brazil by acquiring a local aluminium fabricator. This acquisition is expected to enhance Norsk Hydro's production capabilities and market reach, allowing the company to better serve its customers in the region. The strategic importance of this move lies in its potential to streamline operations and improve supply chain efficiencies, which are critical in a competitive landscape where responsiveness to market demands is essential.

As of November the competitive trends in the aluminium metals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and meet evolving consumer expectations. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these trends and leverage them for strategic advantage.