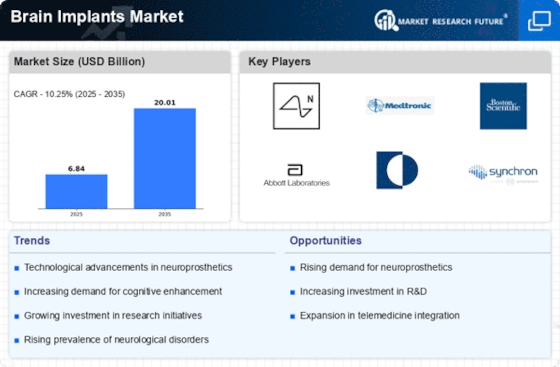

Brain Implants Size

Brain Implants Market Growth Projections and Opportunities

Epilepsy is a brain disorder characterized by repeated seizures, which are sudden changes in behavior caused by temporary disruptions in the brain's electrical activity. Normally, the brain produces small electrical impulses in an organized pattern. However, in epilepsy, this orderly pattern is disturbed, leading to seizures. The global prevalence of epilepsy is on the rise, and the increasing healthcare expenditure is contributing to the growth of the market. Despite this, challenges such as high treatment costs per patient and regulatory restrictions on profitability may hinder market growth.

According to a 2017 report from the World Health Organization (WHO), approximately 50 million people worldwide suffer from epilepsy, making it one of the most common neurological diseases globally. Alarmingly, nearly 80% of individuals with epilepsy reside in low- and middle-income countries. Many people with epilepsy and their families face stigma and discrimination in various parts of the world. In the United States, the morbidity and mortality weekly report of 2017 indicated a growing number of people living with epilepsy. The global epilepsy market is projected to experience a Compound Annual Growth Rate (CAGR) of 8.20% from 2018 to 2023. In 2017, the Americas led the market with a 41.0% share, followed by Europe at 31.5%, and Asia-Pacific at 20.8%. The market is categorized based on condition, diagnosis and treatment, and end user.

In terms of condition, the "others" segment held the largest market share of 70.5% in 2017, amounting to USD 4,184.80 million. This segment is expected to register a CAGR of 7.83% during the forecast period.

When considering diagnosis and treatment, the treatment segment dominated the market with a 66.2% share in 2017, valued at USD 3,929.51 million. It is projected to grow at a CAGR of 7.91% during the forecast period.

Regarding end users, hospitals accounted for the largest market share at 29.3% in 2017, with a value of USD 1,739.22 million. This segment is expected to register a CAGR of 8.20% during the forecast period.

The increasing prevalence of epilepsy globally underscores the importance of addressing this neurological disorder. Despite the market's growth, challenges such as high treatment costs and regulatory restrictions need to be overcome to ensure that individuals with epilepsy receive adequate care and support. Efforts to reduce stigma and discrimination associated with epilepsy are also crucial in enhancing the quality of life for affected individuals and their families. As research and development in the field of epilepsy continue, there is hope for improved treatments and better outcomes for those living with this challenging condition.

Leave a Comment