- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

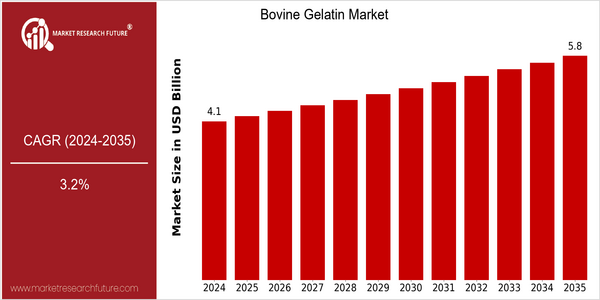

| Year | Value |

|---|---|

| 2024 | USD 4.1 Billion |

| 2035 | USD 5.8 Billion |

| CAGR (2025-2035) | 3.2 % |

Note – Market size depicts the revenue generated over the financial year

The global bovine gelatin market is poised for steady growth, with a current market size of USD 4.1 billion in 2024, projected to reach USD 5.8 billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.2% from 2025 to 2035. The market's expansion can be attributed to several factors, including the increasing demand for gelatin in the food and beverage industry, where it is utilized as a gelling agent, stabilizer, and thickener. Additionally, the rising popularity of gelatin-based products in the pharmaceutical and cosmetic sectors further fuels market growth, as consumers seek natural and versatile ingredients in their products. Technological advancements in gelatin extraction and processing methods are also contributing to market growth, enhancing product quality and reducing production costs. Key players in the bovine gelatin market, such as Gelita AG, PB Gelatins, and Rousselot, are actively engaging in strategic initiatives, including partnerships and investments in research and development. For instance, these companies are focusing on innovative product launches that cater to the evolving consumer preferences for clean-label and sustainably sourced ingredients, thereby positioning themselves to capitalize on the growing market opportunities.

Regional Market Size

Regional Deep Dive

The Bovine Gelatin Market is characterized by diverse dynamics across different regions, influenced by factors such as consumer preferences, regulatory frameworks, and economic conditions. In North America, the market is driven by a growing demand for gelatin in the food and pharmaceutical industries, while Europe showcases a strong inclination towards high-quality, sustainably sourced gelatin. The Asia-Pacific region is witnessing rapid growth due to increasing disposable incomes and a rising trend in health and wellness products. Meanwhile, the Middle East and Africa present unique challenges and opportunities, with varying levels of market maturity and regulatory environments. Latin America is also emerging as a significant player, driven by its agricultural base and increasing exports of gelatin products.

Europe

- The European Union has implemented stricter regulations regarding the sourcing of bovine gelatin, emphasizing traceability and animal welfare, which is shaping the market towards more ethical sourcing practices.

- Companies such as Rousselot and Weishardt are leading the way in developing plant-based alternatives to bovine gelatin, responding to the increasing demand for vegetarian and vegan products in the region.

Asia Pacific

- The rise of the health and wellness trend in countries like China and India is driving demand for bovine gelatin in dietary supplements and functional foods, with local companies like Nitta Gelatin and India Gelatine & Chemicals expanding their product lines.

- Government initiatives aimed at boosting the food processing industry in countries like Thailand are creating new opportunities for gelatin manufacturers, fostering innovation and investment in the sector.

Latin America

- Brazil is becoming a significant exporter of bovine gelatin, with government support for the meat industry enhancing production capabilities and opening new markets in Asia and Europe.

- Local companies are focusing on sustainable practices and certifications to meet international standards, which is expected to boost the competitiveness of Latin American gelatin in the global market.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines on the use of bovine gelatin in food products, which is expected to enhance consumer confidence and expand market opportunities for manufacturers.

- Key players like Gelita AG and PB Gelatins are investing in innovative production techniques to improve the quality and sustainability of bovine gelatin, aligning with the growing consumer demand for clean-label products.

Middle East And Africa

- The halal certification of bovine gelatin is becoming increasingly important in the Middle East, with organizations like the Islamic Food and Nutrition Council of America (IFANCA) providing guidelines that are shaping market dynamics.

- Emerging markets in Africa are seeing a rise in local production of bovine gelatin, with companies like Gelita establishing operations to cater to regional demand, thus reducing reliance on imports.

Did You Know?

“Bovine gelatin is not only used in food products but also plays a crucial role in the pharmaceutical industry, where it is used in the production of capsules and drug delivery systems.” — International Journal of Pharmaceutics

Segmental Market Size

The Bovine Gelatin Market is currently experiencing stable growth, driven by increasing demand in the food, pharmaceutical, and cosmetic industries. Key factors propelling this segment include the rising consumer preference for natural and clean-label products, as well as stringent regulatory policies that favor the use of gelatin in various applications. Additionally, advancements in extraction and processing technologies enhance the quality and functionality of bovine gelatin, further boosting its appeal. Currently, the adoption of bovine gelatin is in a mature stage, with notable players like Gelita AG and PB Gelatins leading the market. Primary applications include food products such as desserts and confectionery, pharmaceutical capsules, and cosmetic formulations. Trends such as the growing emphasis on sustainability and health-conscious consumption are catalyzing demand, while events like the COVID-19 pandemic have heightened interest in gelatin's potential health benefits. Technologies such as hydrolysis and innovative extraction methods are shaping the segment's evolution, ensuring that bovine gelatin remains a versatile ingredient across multiple industries.

Future Outlook

The Bovine Gelatin Market is poised for steady growth from 2024 to 2035, with a projected market value increase from $4.1 billion to $5.8 billion, reflecting a compound annual growth rate (CAGR) of 3.2%. This growth trajectory is underpinned by rising demand across various sectors, including food and beverage, pharmaceuticals, and cosmetics, where gelatin is valued for its gelling, thickening, and stabilizing properties. As consumer preferences shift towards natural and clean-label products, the demand for bovine gelatin is expected to rise, particularly in regions with a strong culinary tradition of gelatin-based products, such as Europe and North America. Key technological advancements and regulatory frameworks will play a crucial role in shaping the market landscape. Innovations in extraction and processing techniques are likely to enhance the quality and functionality of bovine gelatin, making it more appealing to manufacturers. Additionally, as health and safety regulations become more stringent, companies that prioritize transparency and sustainability in their sourcing practices will gain a competitive edge. Emerging trends, such as the increasing popularity of plant-based alternatives, may also influence the market, prompting gelatin producers to explore hybrid formulations or alternative sources to meet evolving consumer demands. Overall, the Bovine Gelatin Market is set to experience robust growth, driven by a combination of traditional applications and innovative developments.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 8.50% (2023-2032) |

Bovine Gelatin Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.