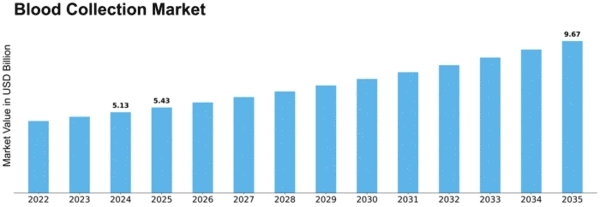

Blood Collection Size

Blood Collection Market Growth Projections and Opportunities

The blood collection market is influenced by a myriad of factors that contribute to its growth and evolution. Firstly, the increasing prevalence of chronic diseases and infectious illnesses worldwide drives the demand for blood collection products and services. Conditions such as cancer, cardiovascular diseases, and blood disorders require regular blood tests for diagnosis, monitoring, and treatment evaluation. As the global burden of these diseases continues to rise, healthcare facilities rely heavily on efficient blood collection systems to meet the growing demand for diagnostic testing.

Secondly, advancements in healthcare infrastructure and the expansion of healthcare facilities contribute to market growth. With the increasing emphasis on preventive care and early disease detection, healthcare providers are investing in state-of-the-art blood collection equipment and supplies to improve patient care and diagnostic accuracy. Moreover, the growing trend towards decentralized healthcare delivery models, such as point-of-care testing and home-based diagnostics, further drives the demand for convenient and reliable blood collection devices.

Another significant factor driving the blood collection market is the rising demand for blood transfusions and blood products. Blood transfusions are essential for treating various medical conditions, including trauma, surgery, and severe anemia. Additionally, advancements in medical procedures and technologies have expanded the applications of blood products in areas such as organ transplantation, hematology, and oncology. As a result, blood collection agencies and blood banks play a crucial role in ensuring an adequate and safe blood supply to meet the needs of patients and healthcare facilities.

Moreover, favorable regulatory policies and government initiatives aimed at promoting blood donation and transfusion safety contribute to market growth. Regulatory agencies worldwide impose stringent standards and guidelines for blood collection, processing, and storage to minimize the risk of transfusion-transmitted infections and ensure the quality and safety of blood products. Government-sponsored programs and campaigns that raise awareness about the importance of blood donation and encourage voluntary blood donors also support market expansion.

Furthermore, technological innovations in blood collection devices and techniques drive market development. Manufacturers are continuously introducing advanced blood collection products that offer improved safety, efficiency, and patient comfort. For example, the development of vacuum blood collection systems, safety-engineered needles, and preanalytical automation solutions has revolutionized the blood collection process, reducing the risk of needlestick injuries, contamination, and specimen mishandling. These technological advancements enhance workflow efficiency, streamline sample collection procedures, and improve patient satisfaction.

Additionally, demographic trends such as population aging and urbanization impact the blood collection market. The aging population is more susceptible to chronic diseases and age-related conditions that require regular blood tests and medical interventions. Urbanization, on the other hand, leads to increased access to healthcare services and diagnostic facilities, driving the demand for blood collection services in urban areas. As urban populations grow and healthcare infrastructures expand, the demand for blood collection products and services is expected to rise accordingly.

Leave a Comment