Decentralized Energy Trading

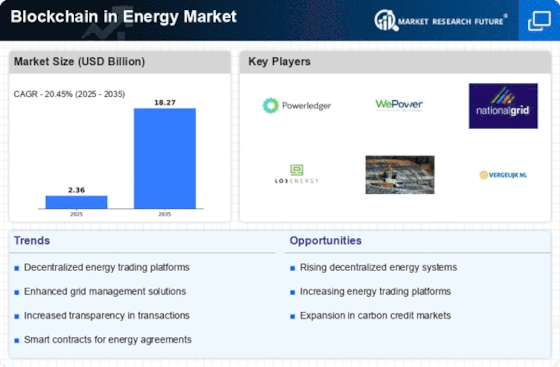

The Blockchain in Energy Market is witnessing a surge in decentralized energy trading platforms. These platforms enable peer-to-peer energy transactions, allowing consumers to buy and sell energy directly without intermediaries. This model not only reduces costs but also enhances market efficiency. According to recent data, decentralized trading could potentially increase market participation by up to 30%, fostering a more competitive environment. As consumers become more empowered, the demand for such platforms is likely to grow, driving innovation and investment in the Blockchain in Energy Market. Furthermore, regulatory frameworks are evolving to support these initiatives, indicating a shift towards more flexible energy markets.

Regulatory Support and Frameworks

Regulatory support is increasingly shaping the Blockchain in Energy Market. Governments and regulatory bodies are recognizing the potential of blockchain to enhance energy market efficiency and consumer protection. Initiatives aimed at creating favorable regulatory frameworks are emerging, which could facilitate the adoption of blockchain technologies. For instance, some jurisdictions are exploring pilot programs to test blockchain applications in energy trading and grid management. This proactive approach may lead to a more structured environment for blockchain implementation, encouraging investment and innovation within the Blockchain in Energy Market. As regulations evolve, they are likely to provide the necessary guidance for stakeholders to navigate this complex landscape.

Enhanced Transparency and Security

In the Blockchain in Energy Market, enhanced transparency and security are paramount. Blockchain technology provides an immutable ledger that records all transactions, ensuring that data is tamper-proof and easily auditable. This level of transparency is crucial for building trust among stakeholders, including consumers, energy producers, and regulators. Recent studies suggest that implementing blockchain solutions can reduce fraud and errors in energy transactions by up to 50%. As the industry grapples with issues of data integrity and security, the adoption of blockchain is likely to become a standard practice, thereby transforming operational protocols within the Blockchain in Energy Market.

Cost Reduction and Operational Efficiency

Cost reduction and operational efficiency are driving forces in the Blockchain in Energy Market. By automating processes and reducing the need for intermediaries, blockchain technology can significantly lower transaction costs. Reports indicate that companies implementing blockchain solutions can achieve operational savings of up to 20%. This efficiency not only benefits energy producers but also consumers, as lower costs can translate into reduced energy prices. As the industry continues to seek ways to optimize operations, the adoption of blockchain is likely to accelerate, positioning the Blockchain in Energy Market as a leader in innovative energy solutions.

Integration with Renewable Energy Sources

The integration of renewable energy sources into the existing grid is a critical driver in the Blockchain in Energy Market. Blockchain technology facilitates the tracking and verification of renewable energy generation, ensuring that energy produced from sustainable sources is accurately accounted for. This capability is essential as countries aim to meet their renewable energy targets. Data indicates that blockchain can streamline the certification process for renewable energy credits, potentially reducing administrative costs by 40%. As the push for sustainability intensifies, the Blockchain in Energy Market is expected to play a pivotal role in supporting the transition to a greener energy landscape.