Market Share

Introduction: Navigating the Competitive Landscape of Blister Packaging

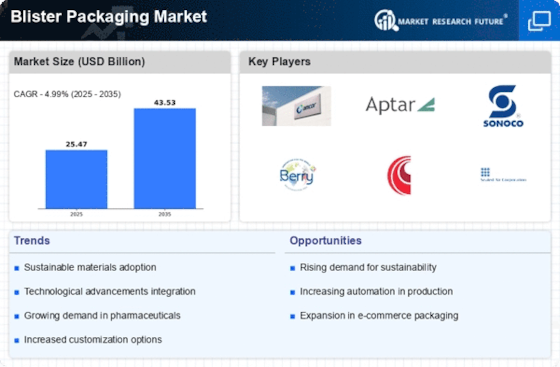

The blister market is undergoing a transformation due to rapid technological developments and changing consumer expectations. The blister industry is also experiencing an upturn in competition, with the proliferation of automation and IoT solutions, which is creating a lively and highly competitive environment. Artificial intelligence is being used to optimize production and customer engagement, while regulatory changes are reshaping the use of materials and methods. The industry is also being transformed by the emergence of green technology, as traditional suppliers of infrastructure and equipment are collaborating with companies from the green economy to meet the growing demand for sustainable solutions. Strategically, emerging markets in Asia-Pacific and Latin America offer significant opportunities for growth, as the strategic trends focus on improving supply chain efficiency and meeting local preferences. In the future, C-level managers and strategic planners need to understand these changing competitive dynamics to make the most of the blister market's potential.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the blister packaging value chain, integrating multiple technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Amcor plc | Global leader in sustainable packaging | Flexible and rigid packaging solutions | Global |

| Constantia Flexibles GmbH | Innovative packaging solutions with sustainability focus | Flexible packaging and labels | Europe, Americas, Asia |

| Sonoco Products Company | Diverse packaging solutions with strong customer service | Protective packaging and blister packs | North America, Europe, Asia |

| Winpak Ltd. | High-quality packaging with a focus on food safety | Flexible and rigid packaging | North America |

| West Rock Company | Integrated packaging solutions with sustainability initiatives | Paper and packaging solutions | North America, Europe |

Specialized Technology Vendors

These vendors focus on specific technologies or innovations within the blister packaging sector, providing niche solutions.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Honeywell International, Inc | Advanced automation and control technologies | Packaging automation solutions | Global |

| Uflex Ltd | Strong focus on flexible packaging innovations | Flexible packaging solutions | Asia, Americas |

| Tekni-Plex, Inc | Specialized in medical and pharmaceutical packaging | Pharmaceutical packaging solutions | Global |

| ACG Pharmapack Pvt. Ltd. | Expertise in pharmaceutical packaging | Blister packaging for pharmaceuticals | Asia, Europe |

Infrastructure & Equipment Providers

These vendors supply the machinery and equipment necessary for blister packaging production, focusing on efficiency and technology.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Klockner Pentaplast Group | High-performance films for blister packaging | Rigid films and packaging solutions | Global |

| SteriPack Group | Specialized in sterile packaging solutions | Sterile blister packaging | Europe, North America |

Emerging Players & Regional Champions

- – PACKTECH (India): The company specializes in eco-friendly blister packaging solutions and recently won a contract with a major pharmaceutical company to provide sustainable packaging, challenging established suppliers by focusing on the environment and cost-effectiveness.

- BlisterPack Innovations (USA): Provides custom-made blister-pack solutions for the food and pharmaceutical industries. Its new production line reduces waste and increases flexibility and speed of production.

- EcoBlister (Germany) specializes in biodegradable blister packaging. It recently formed a partnership with a major cosmetics manufacturer to offer sustainable packaging solutions, and is positioning itself as a competitor to the plastics industry.

Regional Trends: By 2024, the blister packaging market is showing a marked trend towards the sustainable use of materials, with the use of more and more eco-friendly materials in Europe and North America. In addition, the development of automation and personalization is reducing lead times and increasing efficiency, especially in Asia-Pacific. Also, the demand for specialized packaging solutions for certain industries such as pharmaceuticals and food is rising, causing a diversification of the products of the new entrants.

Collaborations & M&A Movements

- Amcor and WestRock announced a partnership to develop sustainable blister packaging solutions aimed at reducing plastic waste in the pharmaceutical sector, enhancing their competitive positioning in the eco-friendly packaging market.

- Bristol-Myers Squibb acquired a minority stake in a startup specializing in smart blister packaging technology to improve patient adherence and tracking, thereby strengthening its market share in the pharmaceutical packaging industry.

- Sealed Air Corporation and Huhtamaki entered into a collaboration to innovate biodegradable blister packaging materials, responding to increasing regulatory pressures for sustainable packaging solutions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Material Innovation | Amcor, Sonoco | Amcor has introduced a new line of biodegradable blister packaging that reduces environmental impact, while Sonoco focuses on using recycled materials in their packaging solutions, enhancing sustainability. |

| Automation and Efficiency | UFP Technologies, WestRock | UFP Technologies has implemented advanced automation in their production lines, resulting in a 30% increase in efficiency. WestRock utilizes smart manufacturing technologies to streamline operations and reduce waste. |

| Customization and Design Flexibility | Berry Global, Sealed Air | Berry Global offers customizable blister packaging solutions tailored to specific product needs, while Sealed Air provides innovative design options that enhance product visibility and consumer appeal. |

| Regulatory Compliance | Mondi Group, AptarGroup | Mondi Group has established a robust compliance framework to meet global packaging regulations, ensuring safety and quality. AptarGroup focuses on developing packaging that meets stringent pharmaceutical standards. |

| Sustainability Initiatives | Smurfit Kappa, Constantia Flexibles | Smurfit Kappa has committed to using 100% recyclable materials by 2025, while Constantia Flexibles has launched a range of eco-friendly blister packs that minimize plastic use. |

Conclusion: Navigating Blister Packaging's Competitive Landscape

The blister-packaging market in 2024 will be characterized by a high degree of competition and a considerable degree of fragmentation, with both established and new players competing for market share. The regional trends point to a growing demand for sustainable packaging solutions, which will force suppliers to respond with innovation and new products. The large established companies will rely on their wide distribution networks and brand loyalty, while the newcomers will focus on their agility and their state-of-the-art technology. The leading suppliers will be the ones who will be able to combine their strengths in terms of AI-driven data analysis, automation of the production processes and a sustainable approach. Strategic investment in flexibility and technological development will be crucial for capturing new opportunities and responding to changing consumer preferences.

Leave a Comment