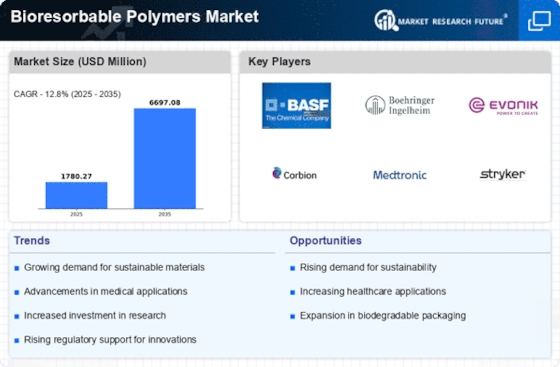

Top Industry Leaders in the Bioresorbable Polymers Market

The bioresorbable polymers market is a dynamic and rapidly growing space, driven by advancements in medical technology and a rising demand for minimally invasive procedures. Tthis market is attracting significant attention from established players and emerging startups alike. Let's delve into the competitive landscape, exploring strategies, key factors for market share, industry news, and recent developments in the last six months.

Strategies Adopted by Players:

-

Product Diversification: Leading players like Evonik, Corbion, and BASF are expanding their portfolios beyond traditional synthetic polymers, investing in natural polymers like hyaluronic acid and polylactic acid (PLA) to cater to growing sustainability concerns. -

Vertical Integration: Companies like Teijin and Resmed are strengthening their control over the supply chain by acquiring raw material suppliers and expanding manufacturing capabilities. This ensures stable supply and cost optimization. -

Technological Innovation: Research and development efforts are focused on developing new bioresorbable polymers with enhanced properties like faster degradation rates, improved biocompatibility, and targeted drug delivery capabilities. -

Regional Expansion: Established players are entering emerging markets like China and India, which offer significant growth potential due to their large populations and increasing healthcare spending. -

Partnerships and Collaborations: Strategic partnerships between polymer manufacturers, medical device companies, and research institutions are accelerating innovation and enabling faster product development cycles.

Factors Influencing Market Share:

-

Product Portfolio: Companies with a diverse range of bioresorbable polymers catering to various applications hold a competitive advantage. -

Manufacturing Capacity and Efficiency: Scalable and cost-effective production capabilities are crucial for maintaining market share and profitability. -

Regulatory Approvals: Navigating complex regulatory requirements for medical devices can be a barrier for new entrants, giving established players an edge. -

Brand Recognition and Reputation: Strong brand recognition and a proven track record of safety and efficacy are crucial for attracting customers and healthcare professionals. -

Investment in Research and Development: Continuous innovation in new polymers and applications keeps companies ahead of the competition.

List of the Key Companies in the Bioresorbable Polymers market include

- Evonik Industries AG

- Corbion NV, Foster Corporation

- Poly-Med Inc.

- REVA Medical, Inc

- Groupe PCAS

- Merck KGaA

- Koninklijke DSM N.V

- KLS Martin

- Ashland

Recent Developments:

Stryker has introduced a Citrefix suture anchor system using Citregen biomaterial for foot and ankle surgical procedures, as revealed by December 2022 news. Citregen is an elastomeric material described as biocompatible due to its resemblance with citrate polymers, which biomimetics native bone structures while promoting absorption via the reduction of chronic inflammation. The pack involves a Citrefix disposable suture anchor system consisting of resorbable bio-mimetic anchors. Michael Rankin, who is Vice President of Marketing & Medical Education at Stryker Foot & Ankle, said: “Our customers will now benefit from the expanded use of one of the most innovative bioresorbable materials available for use in foot and ankle procedures.

May 2020: Evonik Industries AG announced its development of a new advanced biomaterial manufacturing facility in Birmingham, Alabama, US. The facility will expand the good manufacturing practices (GMP) compliant production capacity of RESOMER bioresorbable polymers to meet growing market demand for their application with implantable medical devices and parenteral medicines.

September 2022: Ashland Group announced the plan for the expansion of its Viatel bioresorbable polymer manufacturing and research & development site at the National Science Park. This is home to a network of innovative organizations, in Mullingar, Ireland which showcases commitment to innovation in the long-acting injectables. The capital expansion program commenced in June 2022 and is expected to complete in 2024.