Biorational Pesticides Size

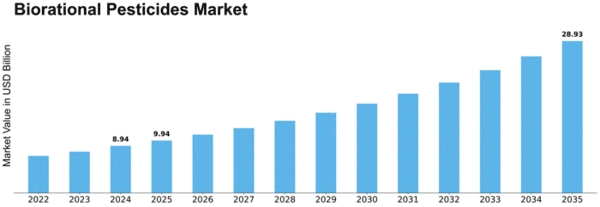

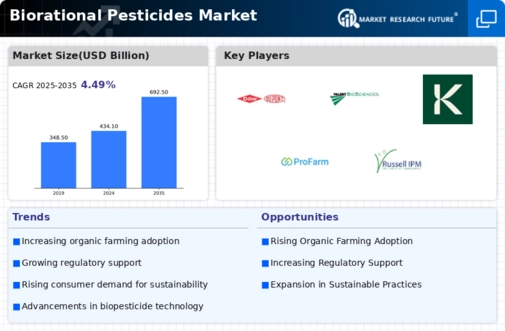

Biorational Pesticides Market Growth Projections and Opportunities

Biorational Pesticides Market is undergoing dynamic shifts, influenced by several key factors that collectively shape its market dynamics. One of the primary drivers fueling the growth of this market is the increasing global concern over the environmental and health impacts of traditional chemical pesticides. As awareness about sustainable and eco-friendly agricultural practices rises, there is a growing demand for biorational pesticides. These products are derived from naturally occurring substances such as microorganisms, botanical extracts, and minerals, offering effective pest control while minimizing harm to non-target organisms and the environment. The heightened emphasis on environmentally conscious farming practices positions biorational pesticides as a key solution, impacting the overall market dynamics.

The evolution of integrated pest management (IPM) practices is another significant factor influencing the market dynamics of biorational pesticides. Integrated pest management involves the strategic use of various pest control methods, with an emphasis on prevention and the reduction of chemical inputs. Biorational pesticides align seamlessly with the principles of IPM, providing farmers with effective tools to manage pest populations while minimizing the reliance on synthetic chemicals. The adoption of IPM practices is driving the market's growth, reshaping conventional pest control strategies, and contributing to the dynamic nature of the biorational pesticides market.

The changing regulatory landscape is a critical factor shaping the market dynamics of biorational pesticides. Governments and regulatory bodies around the world are increasingly recognizing the benefits of biorational pesticides in terms of reduced environmental impact and lower risks to human health. As a result, there is growing support for these products through regulations that encourage their use and streamline the approval process. Regulatory backing contributes to market growth and fosters confidence among farmers and stakeholders, influencing the overall market dynamics.

The consumer shift towards organic and sustainably produced food is driving the demand for biorational pesticides. As consumers become more conscious of the residues left on food crops by traditional pesticides, there is a growing preference for products grown using environmentally friendly pest control methods. Biorational pesticides, with their minimal impact on the environment and residue levels, cater to this consumer demand for safer and healthier food options. The alignment with organic farming practices is influencing market dynamics, as farmers seek alternatives that resonate with changing consumer preferences.

The continuous research and development efforts in the field of biorational pesticides contribute significantly to the market's dynamic nature. Companies and research institutions are investing in developing new formulations, improving efficacy, and expanding the range of pests targeted by biorational pesticides. This innovation-driven approach ensures that the market stays responsive to the evolving challenges posed by pest resistance and changing pest profiles, fostering growth and adaptability.

Global collaborations and partnerships within the agricultural sector are also playing a role in shaping the market dynamics of biorational pesticides. Companies are joining forces to enhance research capabilities, share knowledge, and bring innovative products to market. These collaborations contribute to the market's evolution by facilitating the exchange of expertise and ensuring that biorational pesticides meet the diverse needs of farmers across different regions.

In conclusion, the Biorational Pesticides Market is experiencing dynamic changes driven by factors such as the global shift towards sustainable and eco-friendly agriculture, the evolution of integrated pest management practices, changes in the regulatory landscape, consumer preferences for organic products, continuous research and development efforts, and collaborative initiatives within the industry. As these factors continue to evolve, the biorational pesticides market is poised for sustained growth, offering a viable and environmentally friendly alternative to traditional chemical pesticides in the ongoing quest for sustainable and resilient agriculture.

Leave a Comment