- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

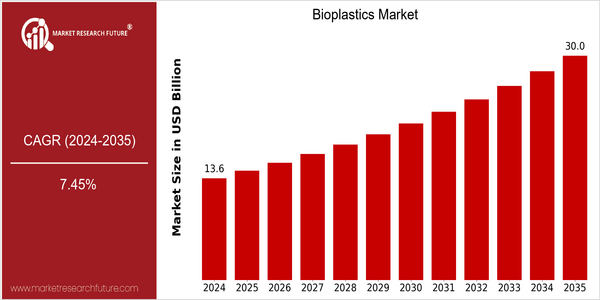

| Year | Value |

|---|---|

| 2024 | USD 13.61 Billion |

| 2035 | USD 30.0 Billion |

| CAGR (2025-2035) | 7.45 % |

Note – Market size depicts the revenue generated over the financial year

Bioplastics Market is expected to reach $ 13.61 billion by 2024 and $ 30 billion by 2035. This growth rate of 7.4 percent is estimated for the period 2025 to 2035. The growing demand for sustainable materials, driven by the rise in the level of environmental awareness and the growing regulatory environment, is mainly responsible for this growth. Bioplastics are increasingly becoming the most viable alternative to conventional plastics in terms of carbon footprint and biodegradability. The development of the biopolymer industry is also a significant growth driver. Using agricultural waste and renewable resources is improving the economics of bioplastics. The major players in the industry, such as BASF, NatureWorks and Novamont, are constantly investing in research and development, forming strategic alliances and launching new products. NatureWorks, for example, has developed Ingeo, a biopolymer based on a renewable resource, which is a clear example of the innovation in this sector. In the coming years, the bioplastics market will continue to grow, driven by the growing demand for sustainable materials.

Regional Market Size

Regional Deep Dive

The bioplastics market is experiencing a steady growth across the globe, driven by the increasing focus on the environment, regulatory support, and technological advancements. In North America, the market is characterized by a strong emphasis on innovation and sustainability. The companies are investing in R & D to develop biodegradable and compostable materials. In Europe, the bioplastics market is mainly driven by regulatory support, while Asia-Pacific is mainly driven by rising consumer demand and industrial applications. The Middle East and Africa are gradually entering the market, influenced by the trend of sustainable development, while Latin America uses its agricultural resources to produce bioplastics from renewable sources.

Europe

- The European Union's Circular Economy Action Plan has set ambitious targets for reducing plastic waste, prompting companies like Novamont and Total Corbion PLA to expand their bioplastics offerings.

- Innovations in bioplastics, such as the development of PHA (polyhydroxyalkanoates) by companies like Danimer Scientific, are gaining traction, particularly in the food packaging sector, which is expected to enhance market penetration.

Asia Pacific

- China is rapidly increasing its production capacity for bioplastics, with companies like Green Dot Bioplastics leading the way in developing biodegradable materials for various applications, including agriculture and packaging.

- India's government has introduced regulations to phase out single-use plastics, creating a favorable environment for bioplastics, with local startups like Ecoplast and Biogreen focusing on sustainable alternatives.

Latin America

- Brazil is leveraging its vast agricultural resources to produce bioplastics, with companies like Braskem investing in sugarcane-based polyethylene, which is expected to enhance the region's market presence.

- Government programs promoting sustainable development and reducing plastic waste are encouraging local manufacturers to explore bioplastics, leading to increased innovation and market growth.

North America

- The U.S. government has implemented initiatives such as the Bioplastics Initiative, which aims to promote the development and commercialization of bioplastics, encouraging companies like NatureWorks and BASF to innovate in this space.

- Recent trends show a surge in consumer demand for sustainable packaging solutions, leading major retailers like Walmart to commit to using bioplastics in their packaging by 2025, which is expected to drive market growth.

Middle East And Africa

- The UAE has launched initiatives to promote sustainable practices, including bioplastics, with companies like Bioplastics Middle East working on developing local production capabilities.

- South Africa is seeing increased interest in bioplastics due to its agricultural sector, with projects aimed at converting agricultural waste into bioplastics, which could significantly impact local economies.

Did You Know?

“Bioplastics can be made from a variety of renewable resources, including corn, sugarcane, and even food waste, showcasing the versatility and potential of these materials in reducing environmental impact.” — European Bioplastics Association

Segmental Market Size

This market is experiencing high growth rates, driven by growing demand for sustainable materials and stricter regulations on plastic waste. It is driven by rising awareness of the environment among consumers and by government initiatives to encourage the development of biodegradable alternatives to conventional plastics. In the European Union, for example, the Single Use Plastics Directive requires industry to use bioplastics for packaging and disposable products, thus promoting the shift to eco-friendly solutions. In the process of being scaled up, companies such as BASF and NatureWorks are setting the pace in terms of production and development. Bioplastics are already replacing traditional materials in the packaging industry, in agricultural film, and in the automobile industry. And this trend is accelerating, prompted by a general push for more sustainable products and by companies’ commitment to reducing their carbon footprints. Technological innovations, such as the fermentation of organic acids, have made it possible to develop bioplastics with high performance properties and at the same time with low impact on the environment.

Future Outlook

In the next five years, the bioplastics market is expected to grow at a CAGR of 7.46% from $13,613,800,000 to $3,000,000,000. This growth is mainly due to the growing awareness of the importance of sustainable development and the need to reduce plastic waste. This awareness is also increasing in the business sector, and the use of bioplastics, which are derived from renewable resources, will probably increase in many areas of the economy, such as packaging, automobiles and consumer goods. By 2035, bioplastics are expected to represent about 20 percent of the total plastics market, driven by both consumers' preferences and the regulatory framework, which is intended to reduce the use of traditional plastics. However, the development of new production methods for bioplastics and the improvement of material properties will also contribute to the further development of the market. The development of supportive regulations and incentives that promote the use of sustainable materials will also play an important role in increasing the market share. The development of circular economy initiatives and increased investments in bioplastics research and development will also contribute to shaping the market. In the framework of the transition to a more sustainable economy, the bioplastics market will become an important part of the transition.

Bioplastic Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.