Biometric Banking Size

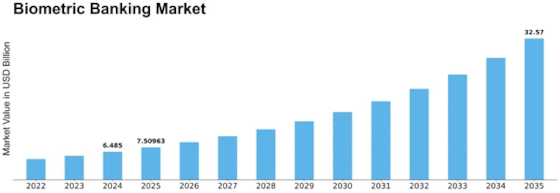

Biometric Banking Market Growth Projections and Opportunities

The Biometric Banking Market is as of now encountering dynamic development, with a few market factors adding to its extension. One of the key drivers is the rising accentuation on upgrading safety efforts in the monetary area. As conventional validation strategies become more helpless against digital dangers, the reception of biometric arrangements in banking gives a strong protection against extortion and unapproved access. Biometric advancements like unique mark acknowledgment, facial acknowledgment, and iris checking offer a more elevated level of exactness and verification, making them essential in getting delicate monetary exchanges.

Another huge market factor is the developing pattern of advanced change in the banking business. With the rising dependence on computerized channels for banking administrations, there is an equal requirement for cutting edge confirmation techniques that guarantee secure and consistent exchanges. Biometric advancements adjust impeccably with this need, giving a helpful and proficient method for checking the character of clients in the computerized domain. The accommodation factor is urgent, as clients progressively request frictionless encounters without settling for less on security, and biometric arrangements take care of this request actually.

In addition, the worldwide flood in cell phone use has moved the reception of biometric banking arrangements. Portable biometric verification has become ordinary, with finger impression and facial acknowledgment highlights coordinated into cell phones for opening gadgets and approving versatile installments. This combination straightforwardly affects the biometric banking market, as monetary organizations influence these inherent elements to upgrade the security of versatile banking applications. The inescapable acknowledgment of versatile banking further speeds up the interest for biometric arrangements, as clients look for secure and easy to use validation techniques on their cell phones.

Administrative drives and consistence necessities likewise assume a critical part in forming the biometric banking market. State run administrations and administrative bodies overall are progressively accentuating the execution of rigid safety efforts to defend monetary information and forestall fraud. Biometric innovations line up with these administrative orders, giving a solid method for meeting consistence necessities while guaranteeing the trustworthiness of monetary exchanges. Monetary organizations, along these lines, put resources into biometric arrangements not exclusively to improve security yet in addition to remain agreeable with advancing administrative norms.

Moreover, the persistent progressions in biometric innovation add to the market's development. Continuous innovative work endeavors bring about advancements like social biometrics and voice acknowledgment, growing the extent of biometric applications in banking. These mechanical progressions improve the exactness of confirmation as well as open up additional opportunities for consistent and unpretentious client check techniques. As the innovation develops, the expense of execution will in general diminish, making biometric arrangements more open to a more extensive scope of monetary organizations.

Leave a Comment