Biomass Size

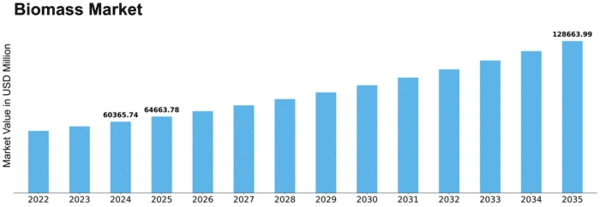

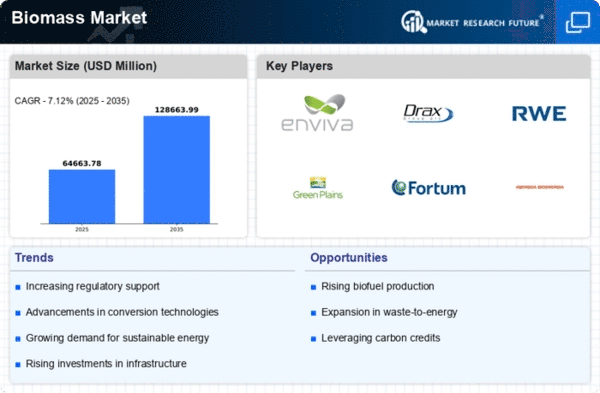

Biomass Market Growth Projections and Opportunities

The Biomass market is influenced by a variety of factors that shape its dynamics and growth trajectory. One significant factor is the increasing focus on renewable energy sources and sustainability. Biomass, which includes organic materials such as wood, agricultural residues, and municipal solid waste, is considered a renewable energy source because it can be replenished relatively quickly compared to fossil fuels. As governments and industries seek to reduce carbon emissions and mitigate climate change, there is a growing demand for biomass as a cleaner alternative to traditional energy sources.

Moreover, policy and regulatory frameworks play a crucial role in shaping the Biomass market. Governments around the world have implemented various incentives, subsidies, and mandates to promote the use of biomass for energy production. These policies include renewable energy targets, feed-in tariffs, tax credits, and renewable energy portfolio standards, which encourage investment in biomass projects and drive market growth. Additionally, regulations governing air quality, emissions, and sustainability criteria influence the production, transportation, and utilization of biomass resources.

Technological advancements also drive market developments in the Biomass sector. Continuous innovation in biomass conversion technologies, such as combustion, gasification, pyrolysis, and anaerobic digestion, improves efficiency, reduces costs, and expands the range of biomass feedstocks that can be utilized. Advancements in biomass pretreatment, enzyme engineering, and fermentation processes also enhance the production of biofuels, biochemicals, and bioproducts from biomass resources, driving market expansion and diversification.

Another key factor is the availability and cost of biomass feedstocks. Biomass resources are derived from a variety of sources, including forestry residues, agricultural residues, energy crops, and organic waste streams. The availability, quality, and cost of these feedstocks vary depending on factors such as geography, climate, land use practices, and supply chain logistics. Fluctuations in feedstock prices, weather patterns, and agricultural yields can impact biomass supply chains and influence market dynamics.

Market competition and industry structure also influence the Biomass market. The market comprises a diverse range of stakeholders, including biomass producers, suppliers, processors, technology providers, and end-users. Competition among biomass suppliers and energy producers drives innovation, efficiency improvements, and cost reductions, benefiting consumers and driving market growth. Additionally, strategic partnerships, joint ventures, and mergers and acquisitions shape the competitive landscape and market dynamics, leading to market consolidation and vertical integration.

Furthermore, economic factors such as energy prices, government subsidies, and market demand influence investment decisions and project economics in the Biomass market. Biomass-based energy projects compete with other renewable energy sources, such as wind, solar, and hydropower, as well as conventional fossil fuels, in the electricity and heat generation markets. Changes in energy policies, market dynamics, and technological advancements impact the competitiveness of biomass-based energy solutions and drive market developments.

Global market trends and geopolitical factors also impact the Biomass market. Shifts in energy consumption patterns, geopolitical tensions, trade policies, and economic developments influence biomass trade flows, market prices, and investment trends. Additionally, international agreements and initiatives aimed at addressing climate change, such as the Paris Agreement and the United Nations Sustainable Development Goals, drive global efforts to promote sustainable biomass production and utilization, shaping market dynamics and opportunities.

Lastly, environmental considerations and public perception play a significant role in shaping the Biomass market. Concerns about deforestation, land use change, biodiversity loss, and air and water pollution associated with biomass production and utilization influence regulatory frameworks, industry practices, and consumer preferences. Sustainable biomass production practices, certification schemes, and transparency initiatives are increasingly important for stakeholders seeking to demonstrate environmental responsibility and meet market demand for environmentally friendly products.

Leave a Comment