Emerging Biological Threats

The Biodefense Market is increasingly influenced by the emergence of novel biological threats, which appear to be evolving in complexity and frequency. Pathogens such as antibiotic-resistant bacteria and engineered viruses pose significant challenges to public health systems. The World Health Organization has identified several high-priority pathogens that require urgent attention, which could potentially drive the market's growth. As these threats become more pronounced, the demand for advanced biodefense solutions, including vaccines and diagnostic tools, is likely to escalate. This trend suggests that stakeholders within the Biodefense Market must remain vigilant and adaptive to the changing landscape of biological risks.

Increased Biodefense Funding

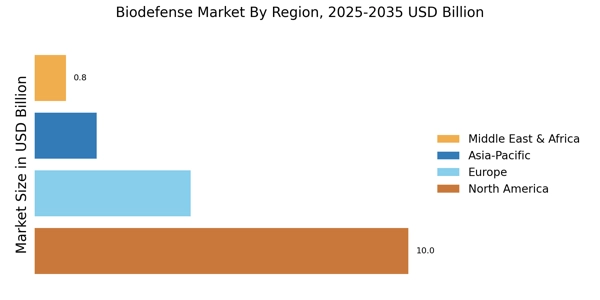

The Biodefense Market is experiencing a notable surge in funding from various governmental and non-governmental entities. This increase is primarily driven by the heightened awareness of biological threats and the necessity for robust defense mechanisms. In recent years, funding allocations have expanded significantly, with estimates suggesting that investments in biodefense could reach upwards of 10 billion dollars annually by 2026. This financial influx is likely to enhance research and development efforts, leading to innovative solutions and technologies that address emerging biological threats. Furthermore, the commitment of resources towards biodefense initiatives indicates a strategic prioritization of public health security, thereby fostering a more resilient infrastructure against potential biological attacks.

Public Awareness and Education

Public awareness regarding biological threats is increasingly influencing the Biodefense Market. As communities become more informed about the risks associated with biological agents, there is a growing demand for educational programs and resources that promote preparedness. This heightened awareness is likely to drive consumer interest in biodefense products and services, including personal protective equipment and vaccination programs. Furthermore, educational campaigns can foster a culture of preparedness, encouraging individuals and organizations to invest in biodefense measures. The potential for increased public engagement suggests that the Biodefense Market may experience a shift towards more consumer-driven initiatives, ultimately enhancing overall resilience against biological threats.

Global Health Security Initiatives

The Biodefense Market is significantly impacted by various health security initiatives aimed at strengthening national and international preparedness against biological threats. Organizations such as the Centers for Disease Control and Prevention and the World Health Organization are actively promoting frameworks that enhance surveillance, response, and recovery capabilities. These initiatives often lead to collaborative efforts among nations, fostering a shared commitment to biodefense. The emphasis on health security is likely to drive investments in biodefense infrastructure, training, and research, thereby creating a more robust market environment. As countries recognize the importance of collective action, the Biodefense Market is poised for sustained growth.

Technological Innovations in Biodefense

Technological advancements are playing a pivotal role in shaping the Biodefense Market. Innovations in biotechnology, genomics, and data analytics are facilitating the development of more effective biodefense strategies. For instance, rapid diagnostic technologies are being deployed to detect biological agents swiftly, thereby enhancing response times during potential outbreaks. The market for biodefense technologies is projected to grow at a compound annual growth rate of approximately 7% over the next five years, reflecting the increasing reliance on cutting-edge solutions. As these technologies continue to evolve, they are expected to provide significant advantages in the prevention and management of biological threats.